How the “retarded apes” could break the financial system

(Article first published Feb 9th, 2021)

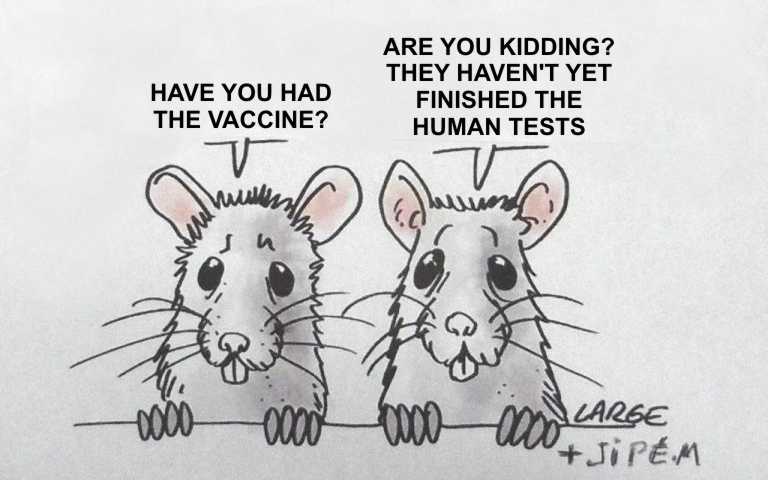

They call themselves retards and apes, I should point out, among other things. The denizens of the wallstreetbets subreddit are individual traders (“retail”, as opposed to institutional) who make highly leveraged, often reckless trades that are indeed more accurately described as bets, and describe their home as purposely offensive as a cultural wall to idiots.

And in what would seem like an idiotic, if not financially suicidal move, they recently and very noisily decided to pile in and beat up a hedge fund, Melvin Capital, which was aggressively shorting the company GameStop – by betting against them en masse. But they won. As a result, Melvin (a decidedly Charlie-Brown name for such a powerful enterprise) had to take emergency loans of almost $3 billion to avoid bankruptcy. A bunch of ordinary traders on a forum fighting against the New Gods of Wall Street – and beating the snot out of them – is a hell of a story.

But it’s just the intro to a much bigger story. What comes next could:

- Damage or destroy more Wall Street institutions

- Expose one of the biggest frauds of the past 40 years

- Send the price of silver up by 100x

- Trigger a market-wide meltdown

Grab your popcorn and let’s go.

GameStop

We’ll make a quick stop at the GameStop saga, because it introduces some characters and concepts that will also appear in the silver squeeze. The original plan for the GameStop short squeeze was posted on Reddit in October 2020. The author figured out that a hedge fund was secretly short on GameStop (ticker: GME) for more shares than were actually available in the market – because some shares were being held by a big long-term investor who didn’t want to sell. Shorting a stock means you think it’s overpriced and will go down (or you want to make it go down). If it drops, you make money. If the price goes up, you lose money.

Now, should that fund need to close or reduce that short position to avoid losses they’d have to buy GME (buying, or going long, is the opposite of shorting). Since in a free market supply and demand determine the price of something, if there are more buyers, the price goes up. You can see where this is going. If a bunch of people start buying, this drives the price up and the shorts start losing money (getting squeezed). If they try to escape or reduce their risk, they make it worse by driving the price up more themselves. With stock options it’s a bit more complex but the same principle applies.

Normally the shorts can exit without much difficulty. But if the market is small enough, and the new buyers for whatever reason do not act like “rational market” participants and refuse to take profits by selling at the higher prices, price can shoot up vertically. If there’s no-one willing to sell enough shares to the shorters so they can close their position, they can in theory suffer infinite losses – that only end when their account gets margin-called (liquidated) by their own broker.

Basically, the Redditors discovered that the hedge fund had got too greedy and had taken such a large position that they were very vulnerable. So they decided to punish them for it. And it worked. The volume of GameStop stock being traded surpassed even that of Tesla. The price rose by 50x from its October low (or a mere 28x counted from the January low) to the highest point on 28th January. And Melvin took a very public loss of at least 30% of its entire capital, many billions of dollars, before it was able to finally close out its shorts.

So the little guy won one. A clear-cut victory for good over evil. Right?

The ethics of the GameStop squeeze

The way Elon Musk speaks sounds to me like he’s visiting from another timeline and trying not to break anything. And even though I’m fond of the roguish android, I disagree with it that short-selling is usually or always morally wrong. It can be an important way to balance the market. Retail investors can even sell short to make money just as institutions do.

There’s a good case that short selling should be regulated in the same way as buying is, and until it is, there is lots of potential for abuse. But this distinction seems to have been lost. There’s a loud and simple narrative that shorting per se is a Bad Thing, which, it turns out, can get people quite excited. The GameStop narrative became retail traders vs hedge funds. Buying = good, selling = bad. It became a crusade.

Causing Melvin losses and effectively transferring that money to ordinary traders is fine by me – everyone in the market knows they can lose as well as win when they take a position. I’m not a fan of the current system; I’ve written about how investment banking is pretty much the worst thing in the history of ever. But hate the game, not the player. To cause a savage amount of good, we need to change the rules, not just arbitrarily move some stonks around.

In any case, the money wasn’t only made by ordinary traders. Wall Street firms are like sharks – if they smell blood they’ll attack even their own kind. Wall Street (Blackrock) is making billions on Gamestop. Melvin themselves have moved on and are quietly making money elsewhere, yet the war continues, I’m not sure against whom exactly.

The likely outcome for retail traders isn’t clear; some made money, but many are now heavily underwater (GameStop’s price has come down significantly as I write this). It’s certainly not black and white.

Robbin’ the Hood

At the height of the kerfuffle, Robinhood, the fee-free trading platform that enabled most of the small traders to do their thing, paused and then restricted trading in all of the controversial stocks. To WallStreetBets, and even to most expert commentators, this was simply a betrayal of the little guy in favour of Wall Street. Robinhood traders were for a while only allowed to sell, which gave the hedge funds some time to wriggle out of their positions. Clearly evil, right?

I don’t think so; just unlucky. Robinhood literally had no choice but to restrict trading. The clearing house that actually does the trades brokered by Robinhood, the National Securities Clearing Corporation (NSCC), judged that the risk to Robinhood from the short squeeze trades had exceeded their limits, which they are required to check by the Securities and Exchange Commission (SEC). The NSCC made Robinhood put up more money to cover this risk. Robinhood is a small fish compared to the hedge funds and investment banks. They didn’t have spare billions to hand. They were forced to reduce risk (halt trading in some stocks) while they negotiated down and borrowed money. Then they opened up trading, but throttled it, to keep risk to themselves under control. Customers of smaller brokers like Robinhood were victims of the huge success of the short squeeze itself.

Robinhood has also come under fire for selling their order book, meaning that big players can see your orders and execute a fraction of a second in front of you. This isn’t exactly ethical, but not getting the best entry on your trades is clearly the price you pay for “free” trading. If you’re not paying for the product, you are the product.

– Shut up and tell us about silver already.

Alright alright.

#silversqueeze

As the squeeze of GameStop (and a few other meme stocks) got under way, multiple WallStreetBets users suggested that silver would be a great target for a squeeze. The rationale is that the silver market is highly manipulated. Long and shorts must be evenly balanced, but it’s always large numbers of the little guys that are long (people like silver), whereas the few massive short positions are concentrated in the hands of a very few banks. This squeeze, too, has a strong ethical aspect to it. As the Original Poster said: “Join me brothers. Let’s take silver to the moon and take on the biggest and baddest manipulators in the world.”

To see why this idea is important, we need to remember what silver is.

Silver and gold are real money

I’ve written elsewhere about why silver and gold are real money (the only real money, until Bitcoin comes of age, which it looks like she is doing this year). Precious metals are precious precisely and only because you can’t artificially increase their supply. It’s so hard to mine them that the annual new gold mined, despite the incredible efforts put into it, is usually less than 2% of circulating supply. Contrast this with fiat currencies, which it is the patriotic duty right now of every country or über-country control bloc to spew forth, as if the BRRRRRRRR of the printing presses could drown out the sound of economies, businesses and family incomes being destroyed. Which leads to the second reason why silver is important to us all.

Silver and gold are inflation warnings

Governments like to pretend that they can control inflation, as if it’s a function of interest rates and other things they like to manipulate – sorry, “manage”. With all due respect to Milton Friedman, inflation is a monetary phenomenon only as long as people don’t think too much about it. When it intrudes on daily life, it becomes a psychological phenomenon. Hyperinflation is the example par excellence, being kicked off by a massive increase in the currency supply but accelerated by the fear of ordinary people that prices are going up and will continue to go up – that their money is worth less each day, just like the collection of clowns that caused the cock-up.

So it’s much more important than it might seem for government and their pet banks, if they want to retain power, which is basically all they want, to manage the perception of inflation. This is why you should ignore official inflation statistics. If it’s getting noticeably more expensive to eat, to buy or rent a place to live, to drive, or to hire a workman (they’re sensitive to the costs of parts and materials) – then you have price inflation, no doubt. And the easiest way is simply to look at the price of precious metals.

As much as precious metals have fallen out of favour in recent years by financial professionals as part of a serious investment portfolio, they sure do rise in price when a currency gets weak. That’s the cumulative result of the mass of market participants making conscious or unconscious decisions about how much of which will buy what in the future. Making free decisions! Now that’s just not cricket. Something must be done, what?

So something was.

Enter the COMEX

The manipulation of gold and silver are completely real and totally happen. But it’s much more structural than I even realised … as a response to what gold and silver did in 1979-80 [gold spiked in price nearly 300% in response to inflation], there was a concerted effort to build a structure that could be rolled out and keep the silver and gold price contained. Because clearly if you have a measuring rod for excess, which is what gold and silver are for, then you need to find a way of managing that.

Ned Naylor-Leyland, portfolio manager, Merian Gold & Silver Fund, in The Big Silver Short

Here’s the weak point they exploited: Big players want exposure to precious metals but don’t want the headache of actually buying, transporting, storing and guarding huge amounts of actual silver. They want paper silver.

The modern-day COMEX was formed when the Commodity Exchange Inc. merged with the New York Mercantile Exchange in the 1990s, but these entities had been trading metals futures for decades before that. The COMEX trades futures contracts – paper promises to buy or sell commodities at a defined point in the future. A few participants are genuinely trying to fix a good price for their commodities in advance. But most don’t actually want tonnes of pork bellies or oil delivered to them at the end of the month (mmm, light sweet crude…). They’re using the market to hedge or to speculate, so they settle in cash instead. That’s why it’s completely normal for commodities in general to have around 10 times as many contracts floating about as actual product.

But that does set up the perfect cover for price suppression. All you have to do is to tweak the rules to say that for precious metals specifically, you can sell more contracts than usual without having more physical product.

They create these contracts from thin air, backed with nothing, and sell them to speculators that have no intention of taking delivery of gold [or silver]. As long as they can keep the price flatlined, they kill the interest. Just when it starts to pick up…they just dilute the flow of contracts by 25% and kill the momentum.

Craig Hemke, former securities broker, founder tfmetalsreport.com, in The Big Silver Short

When hungry buyers come for silver, you sell them paper silver (which you can print more of) instead of real silver. Effectively, you’ve then turned hard money into soft money.

Buying physical silver raises prices, because the demand has eaten up some of the supply. Buying paper silver does nothing, because they just create more to replace it. How much more? This would reveal the scale of the price suppression. But it seems that no-one knows.

We have no idea what the over-the-counter silver derivatives are, because they’re not transparent. Just the reportable numbers come to 500 to 1. But if you consider all the hypothecations, you might have 1000 to 1. This is extremely vulnerable if, and only if, the physical demand exceeds the ability to meet the physical supply. That’s why the COMEX has it set up that you’re only allowed to take delivery of 1,500 contracts per month. You’re only allowed to take 7.5 million ounces of silver off the exchange in a delivery month. Everything that’s set up in the futures exchange is for the short, not for the long.

David Morgan, silver analyst and hedge fund advisor, in The Big Silver Short

It’s actually genius. Because buying and selling pressure determine price, the obvious answer, if you never want prices to rise too much, is to enable an unnaturally large selling pressure. Simply invent a new market, and then rig the rules in favour of the sellers. And if anyone notices, label them conspiracy theorists.

This systematic price suppression has been going on for at least 40 years. Why does it work? Because the volume traded on the derivatives is so huge compared to the physical sales that the futures market effectively sets the price. Logically it would be the other way around, but no. The tiny amount of physical silver that must be purchased by the brokers is the last thread that tethers the market to reality.

The market’s easy for them to manipulate. Although they can’t control it 100%. If they could, the prices of gold and silver would be a lot lower. The political and financial elite don’t want a high price of gold, because it negates the legitimacy of the US dollar.

Dave Krantzler, former Wall Street bond trader, author of The Mining Stock Journal, in The Big Silver Short

So far, these elites have got their wish. Silver is priced so low, it’s hardly economical to dig it out of the ground.

A right bunch of bankers

So we know that the price of silver and gold is kept artificially low by the market system itself. This is already a terrible crime, given precious metals’ ancient and venerable role as public servants, alerting us to – and protecting us from – government-induced inflation. But wait, it gets worse.

You might think that whoever issues all these shorts is taking quite a risk, if price were to rise, as it does periodically even in a manipulated market. Well, they would be, if the market was fair. Incredibly, the same people who run the market are also the biggest traders. Trading against them is like playing poker for billions of dollars when they can see all your cards.

The committee that runs the COMEX is basically the banks. The banks have access to the trading systems. They know where the stop losses are set. And having inside information makes it a lot easier to orchestrate a raid on the market.

Dave Krantzler, in The Big Silver Short

In 2008, when JP Morgan (the world’s biggest investment bank) held a short position that was so large it violated Commodities and Futures Trading Commission (CFTC) rules and constituted a staggering 40% of the entire silver futures market, silver coincidentally dropped from $21 to $9. They’re not even trying to hide how much money they’re making from rigging the market.

Ten years later, John Edmonds, a vice-president at JP Morgan, pleaded guilty to price manipulation. He said it was common practice at the firm and done with the knowledge of his superiors.

And it’s still going on. The Bank of Nova Scotia paid $127 million just three months ago to resolve U.S. regulatory and criminal charges relating to gold price manipulation. And in a separate case, far from trying to conceal it or even feeling a little bit guilty, traders from Deutsche Bank were caught on tape boasting about manipulating the price.

When plunder becomes a way of life for a group of men in a society, over the course of time they create for themselves a legal system that authorises it and a moral code that glorifies it.

Frederic Bastiat, The Law, 1848

There have been some charges and convictions, but it’s likely that the majority of manipulating banks got away without even a hundred-million-dollar slap on the wrist. As Bart Chilton, former CFTC commissioner, said: “The standard of evidence was a very high bar. We had direct evidence, voicemail evidence, text evidence, trading evidence – and at some point we had price movement evidence – but we never had all of the things that you needed together in one place. .. We had real stuff that would have played really well in court. .. I did seek a change in the law, and we ultimately got it. But it was not retroactive. Would the same evidence back then result in a charge and a potential conviction on manipulation now? I think so.”

The ethics of a silver squeeze

To the extent that the silver (and gold) price manipulation is unethical, a squeeze on those shorts would seem to be a jolly good idea.

Unfortunately, WallStreetBets seems to have largely decided that the silversqueeze is a distraction orchestrated by the hedge funds to take the spotlight off GameStop and the other squozen stocks (although this could change). They point out that the hated hedge fund and market maker Citadel, who both bought *cough* frontran *cough* orders from Robinhood and bailed out Melvin Capital, quickly bought a large position in the SLV silver fund, and that JP Morgan themselves have long since stopped shorting silver and now are thought to hold the largest physical silver position in the world.

This is all rather missing the point. If your idea of winning is to make a big financial wave AND stop all the people you don’t like from profiting on it, you’ll never win. Especially when the other side are professional sharks.

Hate the game, not the player. If there was ever a chance for the little guy to make a change to the game, this could be it. If keeping the silver price low is a crime, setting it free would be a service to humanity.

What Grant is referring to is the great evil of soft money. I’ve written about how central banks have expanded their mandate and inflicted a constant erosion of value on all of us. Persistent inflation and money creation and the debt-isation of everything must end in tears. Suppression of the price of precious metals is a necessary part of it, and it’s not sustainable. Gold and silver are therefore the Achilles’ Heel of the financial system. They will fly free soon in any case, as they come back in fashion as true inflation protection. The sooner we can rip off that plaster, the better.

Nothing reflects light better than silver. It has the ability to shine a light on the evil that we’ve seen throughout the system.

David Morgan, interview Feb 1st, 2021

A pair of massive Hunts

By the 1970s, the silver futures market was well functioning (it was still illegal, at least in America, to trade in gold at that time). The same could not be said for the dollar, which was haemorrhaging value as official inflation burned through people’s savings, rising from 6% to 14% over the decade. Naturally, there was a flight to silver.

From 1973 to 1980 the Hunt family, especially the brothers Bunker and Herbert, bought huge amounts of physical silver. Politically conservative, they blamed government spending for the inflation that rose inevitably in the wake of Nixon’s decision to abandon the remnants of the gold standard in 1971. In order to make an unmissable point about money you can print and money you can’t, they bought as much as they could – which was a lot.

And then they borrowed more money to buy silver futures. The vast majority of futures contracts are settled in cash, but the Hunts wanted delivery of their physical silver. Since more buyers would likely have followed their example of taking physical delivery, they would have forced the whole issue by removing the relatively small amount of physical silver backing the fraudulently huge supply of contracts off the exchange, forcing the banks to buy more silver at market rates, which were of course rapidly rising, thus exposing and undoing the price suppression racket.

A frontal assault on the banks, like invading Russia in the winter, is usually a losing plan. On the PR front, the Hunts were portrayed as trying to corner the market, i.e. to manipulate the price temporarily up. This was a much easier narrative to understand and remember than some weird tale about inflation, so it became history, and effectively distracted from who the real villains were – the guys keeping it permanently down. Then, at the point where the brothers were most leveraged and most vulnerable, they literally changed the rules.

They were instructed to unload their silver futures position. The COMEX imposed a regulation for a time that if you were going to trade silver on the COMEX, all you could do was sell.

Dave Krantzler, , in The Big Silver Short

That did it. With now infinite selling pressure, the price crashed, and the Hunts’ leveraged long positions lost so much money that it ruined them.

Let’s get physical

If the richest guys in the world couldn’t manage it, how can we? The mistake the Hunts made was to go too heavily into paper silver. They played the sharks in their own pool, and got eaten.

The way to do it is to buy physical silver. Large investors (and there were plenty involved in the GameStop saga) can buy contracts of paper silver and demand delivery. Ordinary folks can buy a few silver coins. The first effect is that investment-ready silver will start to dry up and the physical price will rise. This is actually already happening right now.

Pretty much physical silver is almost all gone in terms of live inventory.

Tyler Wall, president and chief executive officer at SD Bullion, via Bloomberg, 31 Jan 2021

In a sign that buying not limited to disaffected North American Redditors, Asia, too, recorded “unprecedented, broad-based, and deep” demand.

And it’s not just retail traders buying coins. Those with money tend to buy allocated silver in secure vaults, and that is also running out:

How can it happen so fast? The silver market is relatively small, and demand is at least equal to supply (some commentators say that we are in a structural deficit). So even a small change in the supply/demand dynamic can quickly overwhelm the stock.

But didn’t the price immediately fall back after a couple of days? Yes, the spot price did.

Again, this is the fake price largely determined by the futures exchange. The physical price – what the dealers will give you per ounce – is not a nice neat number that you can easily look up on Google. You have to ask dealers. It’s always higher than spot, which is the premium you pay for owning and controlling your own metal. As Bloomberg reports, what’s unusual this time is that “everybody has been raising their premiums”. This would point towards a psychological shift.

Now we’re seeing nothing, no single offer, which is scary. Whatever we sell, people are holding it. There’s no inflow of metal at all.

Peter Thomas, senior vice president at Zaner Group, via Bloomberg, 31 Jan 2021

In a supply crunch, physical prices can be double the spot price. But is this sustainable? Probably not, and that’s the point. To say the spot price is set by the futures is a simplification. It’s actually set on commercial bars. Less than half of the yearly silver production is taken for investment. Now imagine that there is a sustained supply squeeze. Suddenly it becomes worth the trouble to sell some commercial bars to the mints to make coins instead of in bulk to the exchanges and funds. Either the big suppliers would do this, or any investor who could afford a 5,000-ounce futures contract would demand delivery, take their chest of silver and sell it to a refinery or dealer, profiting on the difference between the low futures price and the premium physical price.

This is their weakness. Because the futures price is a lie, COMEX will not be able to source metal at that price. Either they bid up the price of silver, squeezing and eventually breaking the shorts, or they’d try to stop people from taking delivery. They might succeed in dissuading a few small buyers from taking physical delivery, or weasel out using a force majeure clause to settle with them in cash, but not with the Exchange-Traded funds (ETFs).

ETFs, unlike the exchange itself, are in theory required to have 100% silver to back up their shares. If they issue more shares, which they will if price spikes and demand grows, they must source large amounts (although most commentators doubt that SLV, the largest ETF, the custodian of which is JP Morgan, actually have 100% of the claimed silver). When PSLV, the silver ETF run by Eric Sprott (an ally in the fight to expose the shorting), comes calling to the COMEX asking for delivery, and can’t get it, it’s game over. This makes investing in PSLV – not SLV – a viable alternative to holding physical metal if you want to help squeezify. The metals game runs on confidence, just like the fractional reserve banking scam. When everyone is asking point blank “Where’s the silver?” and there’s no answer, any remaining trust in unbacked futures contracts and ETFs expires and the whole sorry scheme collapses.

Is the silver squeeze possible?

As veteran silver analyst Ted Butler said in July 2020: “For years, concentrated short selling on COMEX was led by JPMorgan, but the bank has recently abandoned the short side, leaving 8 other big shorts to deal with a mess when the lid blows off. The moment JPMorgan stops supplying physical silver to the market and refuses to add new COMEX short positions, it does not appear likely that the remaining big shorts can keep the lid on prices.”

Recall two things: JP Morgan is alleged to have accumulated the world’s biggest pile of physical silver, and Wall Street firms are sharks. Now it doesn’t seem so likely anymore that any would-be squeezers would be alone in moving the price back where it belongs. When momentum starts to the upside, JP Morgan would likely throw their weight behind it for easy profit, just as they did for GameStop. If they instead decided to fight to the end, their huge pile could still be bought up, but it would take longer.

So what’s the point of undoing the short squeeze? Why is it such a big deal? Remember that the short positions are artificially large – leveraged many times over. In order to actually close their short positions, the Big 8 short positions would have to buy the equivalent of all the silver produced in the world, every day for 170 days. As soon as one bank starts covering, they will all rush for the exits, and the price will go no-offer.

But is it realistic to expect people to demand physical delivery of silver futures? We can look to gold for a clue. SeekingAlpha reported that as of Sept 2020, 310 times more gold contracts had been settled by physical delivery that year than in the whole of 2018.

It seems that silver shorts can finally be smashed if supply is squeezerised long and hard enough. So the question becomes, can a sustained supply squeeze be orchestrated? In fact, it doesn’t need to be orchestrated. It’s already on the way.

Supply

There are not huge stockpiles of silver just lying around. As fast as it’s produced, it gets used up by industry.

And the pipeline for that supply is falling. According to precious metals consultant Jeff Clark, production from new mines is down 90% from 2003-2019.

Show me a mining company that’s actually increasing their silver production. I don’t know one.

Keith Neumeyer, CEO of First Majestic Corp (a top 10 silver miner by revenue), in The Big Silver Short

There were almost 800 million ounces of silver mined in 2020 according to the Silver Institute. Coins and bars used 215 million ounces of that. Metals dealers often like to say “Everyone should own a little bit.” But they can’t. Even if all the physical investment allocation for the whole year went into coins, there would not be enough for everyone in America (current population 330 million) to put a fiftieth of their stimulus cheque into buying even one 1-oz silver coin each. That’s how little silver there is.

How much does COMEX have? David Morgan, in an interview with Soar Financial Feb 1st 2021, puts it at 150 million ounces. That sounds like a big number, but remember that WallStreetBets has almost 9 million members (the recently started WallStreetSilver group has “only” 40 thousand, but is well worth looking at for up-to-date information). And you don’t have to buy every last bit of it to start the squeezation. Any significant fraction of the investment supply getting bought up would trigger a price rise, which would attract interest, which would raise prices further.

Demand

Silver conducts heat and electricity, and reflects light, better than any other element. It’s essential in industry.

It’s price inelastic. You have to have it, is the problem. There’s no substitute.

David Morgan, interview Feb 1st, 2021

Use of silver in solar photovoltaic (PV) panels has been around 100 million ounces a year for the last four years. But that’s about to change. According to a report from the International Energy Agency in Oct 2020, PV “becomes the new king of electricity supply and looks set for massive expansion.” Electric and hybrid vehicles use silver. Wind turbines use silver. Going green means going silver. And now every major government in the world is looking at massive green energy measures as part of their money-printing “stimulus”.

These very big consumers like Apple, Samsung, Toyota, and Sony all use a lot of these metals. But they’re paranoid to tell you how much they use. I’ve looked these consumers right in the eye and asked them how many ounces of of silver they consume in a year and they will not tell you. They’re absolutely paranoid that the market is going to find out how much silver, copper, and to a lesser degree gold they need. Because if the hedge funds figure out how much the big manufacturers actually need on a daily basis, they’ll start front-running them. All of a sudden BMW, Toyota, Tesla, Apple, etc have to pay higher prices for their metal. It’s almost impossible to actually figure out how much is being consumed.”

Keith Neumeyer, CEO of First Majestic Silver Corp, in The Big Silver Short

Even if we don’t know exactly who is using how much, it’s safe to say industrial demand overall is going to increase dramatically. And what about people buying silver as an investment?

Where there’s demand from the monetary side, which could be epic this year, then the industrial side, they’ll panic. You don’t think those guys talk to each other all the time? Panic will go quickly through the sector.

David Morgan, interview Feb 1st, 2021

Speaking of demand from the monetary side, remember the silver ETFs, who are required to fully back their shares? Transfers of thousands of tonnes of silver are not done by driving it around, which can take months, but by swapping the name tags on existing supplies in vaults such as the LBMA vault in London.

If these ETFs see continued investment inflows, they will all have to compete for the available silver in London … which is at an historic low. A few more days of inflows like the ones seen over 29 January to 2 February would be a major emergency for these ETF providers, because there is just not that much physical silver left in the vaults.

Ronan Manly, precious metals analyst with BullionStar, analysis 8 Feb 2021

So supply is limited, it’s all being used, and both industrial and investment demand are increasing – and will turn into panic at some point.

Simply to say, again, look at what the big money is doing. They’re accumulating before it becomes difficult to get. If it’s priced below the cost of production, if there are only two mining companies making any money, and if the sophisticated investors are buying enormous quantities of it, I think the handwriting is on the wall.

Andy Schectma, owner of precious metals dealer Miles Franklin, in The Big Silver Short

Aside from the ethics of busting the suppression racket, there is serious profit potential in buying silver at current prices, with David Morgan saying he thinks it’s safe to buy “up to $50/oz.”

House of cards

Looking at the shadow contracts and discrepancies in daily contract numbers makes one question all of the gold and silver market data reported by the CME group. Just because the CME reports a number, I know of no audit of the transactional data published to guarantee its authenticity. How do we all now value the gold and silver prices used in our daily physical transactions? The answer is we don’t, and this will lead to a new era in how the public views the gold and silver market. Just like a fear of cash shortages would cause a run on the banking system, fears of physical precious metals could cause a run on whatever is left in the COMEX warehouses.

FX Empire, Sep 7th, 2020

A run on the banking system and a run on precious metals are not so different. Both express a crisis of confidence in the current financial system, the failings of which were brutally exposed in the Global Financial Crisis of 2008 – and never fixed.

The key to maintaining the fiat currency system and the dollar’s reserve status is to contain the price of gold and silver. We’re talking about wrath of God money here that these guys are making from the ability to control the fiat currencies.

Dave Krantzler, in The Big Silver Short

After the Everything Selloff in March 2020, markets were pumped up again only by money-printing, not good fundamentals. This is fragile. According to Real Vision’s Raoul Pal, hedge funds are long the market with significant leverage, and shorts are at all-time lows. If anything spooks the market now – like, say, a rush to precious metals – we could get something like a long squeeze, where they’re all forced to reduce their Value At Risk, cover and sell, and another big crash. It’s not clear how many more shocks the market can take, while the true scale of damage to the world economy is yet to be revealed.

The crisis of 2008 showed the terrifying instability of the global financial system. It also showed something interesting – none of the big players seem interested in looking out for the cliff. As long as there’s money to be made right now, they just keep their foot on the accelerator.

The current system is a massive pyramid of gambling. It steals value from the people that create it and gives it to the political class to play with (see my History of Money series, or anything by James Rickards, if you doubt it). It is deeply unfree, a terrible perversion of capitalism. We can do better.

It’s possible that gold and silver can break free, a few banks take heavy losses, contagion is limited, and the current system limps on, at least for a while. I think it’s more likely that it would bankrupt some, freak out the market, add weight to inflationary forces, and make a more compelling case for a flight out of fiat currencies to hard money. When you look back at all of recorded history, when currencies collapse, people always – always – return to money they can own themselves instead of relying on a “trusted” third party: elemental gold and silver (and perhaps now Bitcoin).

What price the people’s money?

“I’m in touch with the broker who worked with the Hunt Brothers directly, and we agreed on one thing: these people don’t know the kind of sharks they’re dealing with. From my experience of over 4 decades, they’re the master manipulators. But that doesn’t mean that the people’s money can’t return to the people.”

David Morgan, interview Feb 1st, 2021

It feels gauche to make price predictions in the face of the financial fabric unravelling. But it’s worth at least reassuring oneself that one is unlikely to lose money betting on silver.

Governments don’t hold much silver anymore, but they do hold significant gold reserves. One way of estimating a free-market price for gold (IIRC, from the brilliant James Rickards) is by dividing the M1 money supply (cash and cash equivalents) by the amount of gold held by the government. Let’s do this for America, the largest economy in the world, one with decent statistics and a historically large gold reserve.

M1 is $6903,000,000,000 at Jan 25, 2021 according to the Federal Reserve. Gold reserves are 261,498,926 troy ounces in Dec 2020, according to the US Treasury. So a reasonable price might be just shy of $26,400. Seems a little high compared to the current price of $1,800, right? Well they have printed a lot of money recently.

If you refer to the liabilities of the Federal Reserve instead of the M1 money supply, you get a different number:

Look at what % of the Fed’s liabilities is back by gold, and we’re at an historic low, 6%.This happened before: in 1969 it got to 12% and by 1980 it was at 100% because the gold price went to a level that made the Fed totally backed by gold. At that moment, in 1980, the market – not the politicians, not the economists, the market – had returned us to a gold standard. That will happen again, and those numbers are up in the $10,000-$20,000 level.

Dan Oliver, founder of Myrmikan Capital, interview Feb 3rd, 2021

How much silver is there compared to gold? Historically, a ratio of 15:1 has been used. Geologically, it’s more like 9:1. According to mining output, 8:1. In terms of price, the market has usually favoured much higher ratios, averaging 50:1. Now, silver moves in price far more dramatically than gold, and in the last raging bull market, which ended in 1980, the ratio was 17:1.

If we go with market history, we might estimate a peak ratio of 20:1, which would give a fair market price for silver of $500-$1,320 per ounce.

If we’re concerned more about supply and demand we could err closer to the miners and pick 10:1. That would give a fair market price for silver between $1,000-$2,640 per ounce. The high figure is almost exactly one hundred times today’s spot price of $27.

Remember that demand is likely to structurally increase, supply to decrease, and money-printing and Fed asset-buying to continue. This calculation may be flawed, but it’s unlikely to be lower next month or next year. Realise, too, that markets always overshoot, and that price has been suppressed for decades. The peak (not that one should try to pick the top but rather sell into strength) is likely to be far more than fair market value.

How to buy silver

Update: I turned this section into a whole article.

Thanks for reading. If you’re still not convinced, let me know which areas to improve.

If you liked this analysis, please share it in a compelling way with two people who trust you. Let’s get the R0 of this sucker above 1!

TL;DR

Buy physical silver. Thank me later.

References & further reading

If you want to talk to people about this topic and get up-to-date information, join the Reddit community at WallStreetSilver. They have an awesome collection of Due Diligence research.

The brilliant book The Big Silver Short is where I got many of these ideas and a bunch of great quotes. Chris Marcus has done an impressive job of pulling together interviews with experts. Definitely read it to get the detail. He writes and makes video updates at Arcadia Economics.

David Morgan is the silver expert’s expert and another huge source of information for this article. He has a free and a paid information newsletter and writes at The Morgan Report. He nailed the top of the last great silver bull market, and is worth listening to.

For something more serious-looking than this article (without memes, and a bit shorter) to convince your friends, Crescat Capital’s letter to shareholders gives 16 reasons why they are selling equities and investing in gold and silver.

Mike Maloney’s website https://goldsilver.com has an excellent video series on hard money economics, and a free (but high quality) ebook about gold and silver.

If you use Twitter, these guys are good sources of information on gold, silver, and macroeconomics:

This website, which I discovered only after writing this article, covers different aspects of the silver manipulation and what to do about it: https://www.thesilverstory.com

And finally, although I didn’t use Ted Butler’s research directly for this article, all the experts say they learnt from him, so here’s his website: https://www.butlerresearch.com/

Disclaimer

Don’t do anything just because a stranger on the internet tells you to. This is not investment advice.

But seriously, you should buy some silver.

🌍 Share this:

Want more to read? Here are my latest articles: