The elephants in the room

This is the fourth in a series of eight articles:

- A Brief History of Money

- A Brief History of Commercial Banks

- A Brief History of Central Banks

- A Brief History of Investment Banks

- The Global Financial Crisis of 2008 (coming soon)

- The Greater Depression of 2024 (coming soon)

- A Brief History of Global Financial Resets (coming soon)

- The Global Financial Reset of 2025 (coming soon)

In the previous article, we learned why there’s more money every year, but it’s worth less all the time. Now we’ll learn what the big boys do with all this loot, and why it matters to me and you.

Pigs at the trough

Not much money is actually printed anymore. Most of it gets into the system when the central bank magically—I mean, digitally—creates it (or an equivalent such as government bonds) and adds it to the account of a major bank.

[Side note: Bonds are super-important for the history of money and how finances work today. The bond market is older, larger and smarter than the stock market. But there’s not space or time to get into it here. All the arguments and predictions I make come out the same whether we talk about it or not.]

Commercial banks create multiples of that money and lend it out, mostly to ordinary people to buy things they can no longer afford due to inflation, like a place to live or an education.

Investment banks, broker-dealers, and clearing houses help other organisations like hedge funds and private equity funds to trade and invest money. Investment banks and their clients buy assets like stocks using leverage—they borrow money from the broker so they can trade many times what they could otherwise afford.

Because the default for central banks is to pump new money in, it’s being conjured and multiplied all the time.

Where does all this money go?

The stock market is not the economy, Part I

[If you already agree that the stock market is not the economy, click here to skip the charts that prove it.]

While the money supply is ever-increasing, its value is always disappearing due to price inflation. Bankers buy their own houses and cars from their outsized quarterly bonuses, so they are desperate to chase high returns in the immediate future. Not to stabilise the financial system, or even to grow real wealth in the economy.

What is real wealth anyway? It’s the ability to have good living conditions with less input of time and money—an increase in purchasing power. This comes from better technology and sound (non-inflationary) money. It’s stable jobs and businesses, which come from long-sighted, responsible investment and fair competition. We could think of more, but this will do. A properly functioning stock market and intelligently investing funds could in theory help to generate this real wealth.

But at any one time, there are only a certain number of high-quality things to invest in. Sometimes (like if entire markets are over-valued), there is nothing sensible to invest in at all. But because far too much money is chasing too few quality investments every quarter, institutions have to keep buying stuff.

When interest rates are kept artificially low by central banks, there’s not much money to be made in savings or similar slow, safer investments like bonds. The policy of inflation plus low interest rates forces a tidal wave of money towards riskier, higher-return investments instead.

More buying means prices rise. This is why the stock market can go up even while the real economy is getting worse. That’s exactly what’s happened since the 2008 Global Financial Crisis, and it’s happening in an extreme way as I type this.

But stocks always go up

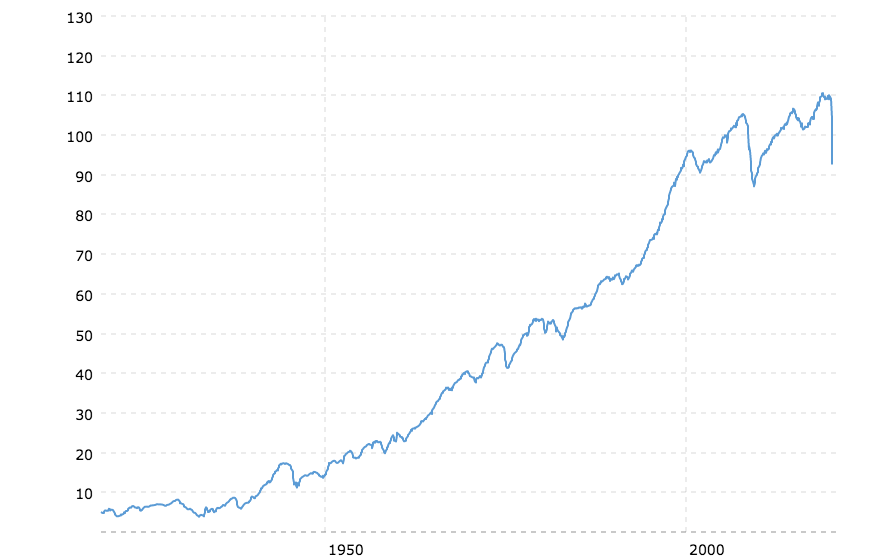

People repeat this as if it’s a natural law, without stopping to wonder if or why it might be true. I have to bring up a chart here.

It’s a bit wild. It has spikes up, sure. But it was lower in 1982 than 1927, 1937, or anytime from 1957 onwards.

What is it? Drumroll… it’s the Dow Jones Industrial Average, a very old and important stock market index, adjusted for (official) inflation. If you’d bought the top in 1929, you’d probably have died before being (briefly) back in profit.

In real terms, the stock market does not always go up even over very long time periods. Or to look at it another way, despite all of the technological progress in that time, the absence of sound money (the constant drain of inflation) robbed society of an incomprehensible amount of value.

This is the same chart of the inflation-adjusted Dow Jones, but going up till the present day:

Look at what happened after investment banking really got going in the 1980s. The dollar had abandoned the last pretence of the gold standard a few years earlier, and bank money was freed to go forth and multiply—and go shopping—like never before.

Was that wild increase in the stock market because things got exponentially better in the real world? Nope.

This is the United States Industrial Production index over the same time period. Production of stuff. (One measure of) the actual economy. In contrast to the stock market, it shows steady progress almost in a straight line.

If you drifted off at the sight of charts, apologies and welcome back. What they prove is that (although it’s obviously related) the stock market is not the economy. During the period that started with the most recent global financial reset in 1971, we’ve been in a bull (up-trending) market in stocks showing less and less connection to the real world and running more and more on fake bank money and financial cleverness.

If it weren’t for the fact that we’ve all been nudged to put our retirement money into pensions that invest in stocks, it would be tempting to say just let it crash.

Pay no attention to the man behind the curtain

The Wizard of Oz used smoke and mirrors to make himself appear bigger and to exert more influence.

To achieve the same thing, banks use magic money—and leverage.

Leverage

Leverage is a fancy word for buying things you really can’t afford. If Charlie has $20 and places a bet worth $200 using borrowed money: a) you’ve got a gambling problem, Charlie, and b) technically, he’s using 10x leverage.

We saw in A Brief History of Commercial Banks that they can’t use all of their capital—sorry, our money—to play with and must keep some of it in reserve as collateral. This puts a limit on the amount of leverage they can use (about 10x in normal times).

Investment banks have different, very complex rules for how much collateral they must keep. But this reserve isn’t an amount of money. Bizarrely, it’s measured on the amount of assets they can sell in one month. In a selling panic, when prices are dropping and buyers disappear, they can find themselves unable to sell fast enough at a good enough price to meet their obligations. So their emergency fund of assets is only useful until there’s an emergency. Genius.

Other types of investing companies have different rules. Some are based offshore and have almost no rules. Long Term Capital Management, which was hours away from causing a financial crisis in 1998, was registered in the Cayman Islands and effectively used “infinite leverage, because the fund refused to post initial margin”.

But wherever they are, banks and funds are all leveraged up as much as possible. They have to be, because they’re competing against each other.

Go big or go home

Every new trader has the same thought when they find out about leverage: “I’m gonna use really high leverage and make so much more profit!” Come back a bit later and they’ve either changed their mind or gone broke.

The problem with leverage is that if you’re wrong even a tiny bit, you can lose everything. As an example, if apples cost £1.00 each and you bet that the price would go up, at 10x leverage, and you were right, but the price of apples first went down to 90p briefly before it went up, you would lose all of your money (your 10% loss multiplied by 10 is 100%).

The more leverage, clearly, the more risk. So how can banks use leverage and keep risk under control?

Hedging

The obvious way to reduce risk is to hedge your trades. Hedging a trade is when you make a second trade as insurance against the first one going wrong.

If Alice buys lots of shares in an ice cream company, she should do well if the summer is sunny. She could hedge against the risk of a wet summer by also buying shares in something that does well in rainy weather like, say, umbrellas.

The prices of umbrellas and ice creams are expected to go in opposite directions depending on the conditions, so, for the sake of argument, Alice expects her net risk—the average risk of both trades added together—to be close to zero.

She’ll make less profit by hedging, but that’s ok. If you can get risk close to zero, you can just make bigger bets using leverage to fatten your profit again. After all, 10 times zero risk is still zero, right?

The hidden risk here is that the risk of the trades is cancelled out only on paper and only most, not all of the time. In an unusual event, the correlation might break down. A severe shortage of oil, for example, would be bad news for both ice cream factories and umbrella makers, and Alice would lose twice as badly. Her risk would be doubled, not cancelled out, by having two trades.

If she was using leverage, her risk would be exponentially higher, perhaps high enough to bankrupt her. When you zoom out, her risk really depends on the total size of all her trades, not her cleverly calculated “net risk”. Of course, for the purposes of assessing risk, size is measured relative to the amount and quality of collateral.

Investment banks don’t hedge with umbrellas but with pairs of financial assets—currencies, equities, rates, bonds, indexes—that have been known to move in opposite directions in response to the same conditions. This strategy, of course, is very clever right up until it isn’t.

Strange things

Hard assets like houses, hand tools, or precious metals have some independent physical existence. Let’s include hard money (reliably backed by something valuable and non-inflationary) and call these things real assets. In our definition, you can own real assets outright without depending on anyone else for that ownership.

A share or a bond is one level more abstract than real assets. It’s not money, but a promise to pay you money—in dividends or interest, after some time. It’s less real than a hard asset but it’s still a financial asset. Banks, for example, keep government bonds as collateral, and companies can raise money using shares as collateral.

But most advanced trading doesn’t even use normal financial assets at all. It uses more abstract things that don’t have any worth of their own. How can this be? They derive their price wholly from other assets, so they’re called derivatives.

The earliest known derivative was created 2,400 years ago when Thales of Miletus, a wise but poor philosopher, paid a small fee to reserve the option to rent all of the local olive presses just before what turned out to be a big harvest year for olives—and therefore a profitable one for Thales as he resold the options.

Simple derivatives include options (you buy the option to buy/sell something at a certain price in the future) and futures (you agree to buy/sell something by a certain date). These assets are used to hedge, or to speculate—to try to turn a profit, especially since they have built-in leverage (the fee to make the reservation is small compared to its price).

Unlike real assets, though, they have counterparty risk. All derivatives are contracts. If you enter into a contract with someone, they might not fulfil their side of the bargain. The counterparty risk of a hedge is, obviously, proportional to the total size of your bets, and not to how neatly they’re supposed to cancel each other out.

Stranger Things

Derivative contracts only became standardised in 1973 with the opening of the Chicago Board of Options Exchange. In the next years, investment banks and their clients poured money into trading the new assets.

As they competed for profits, they started to make even more abstract bets. Starting in the 1980s, there was an explosion of new types of derivatives. In the beginning, these were just creative ways of repackaging and charging for real debt (still a huge market today). But as the sophistication increased, we reached the logical conclusion of the magic money story: banks making bets based on nothing:

Dealers create swaps that have no underlying instrument at all, just an index or formula for paying off bets with no connection to real-world debt.

(James Rickards, The Road to Ruin, Penguin Random House 2016)

What banks actually invest in has changed from debts, to leveraged bets about debts, to…any bet at all that mentions something that sounds financial. If this seems more like gambling than banking to you, you’re not alone. But wait, it gets worse.

Collateral Damage, Part II

Banks and firms that buy or sell stocks and derivatives for themselves or for clients are called broker-dealers. Because they use leverage, they have to put up some collateral. It’s important that the collateral keeps its value, because if it drops, the large trade is secured by a reserve that’s now too small.

The effective leverage then becomes too high, and if more collateral can’t be added, the trade must be shut down immediately. This panic-close is a bit like a small bankruptcy and is called a margin call or forced liquidation. In a forced sale, the trader does not get the best price and typically loses some or all of the collateral. This feels bad.

To avoid this, these trades must be secured by something, well, secure, right?

Nope.

If you or I try to take a collateralised loan, we have to put up a real house or a real car as collateral. But institutional broker-dealers are allowed to use mortgages, student loans, bonds, and mortgage-backed securities as collateral. The biggest trades are backed by nothing but someone else’s debt.

In Collateral Damage, Part I, we saw that the less real the collateral, the more risk there is. Well, the modern system has arrived at a place where real money is just a memory, and debt is considered just as good.

This is sort of alright as long as everyone continues to honour their liabilities—to pay their debts on time. If that changes (perhaps because of some national or global event), counterparty risk is going to spoil the party. Which explains why more and more people are saying variations of this:

Gold is the only financial asset that is not simultaneously someone else’s liability.

Doug Casey, Right on the Money

Just sayin’.

So, banks are gambling with leverage; using debt for collateral; and their trades are vulnerable to counterparty risk. Sounds bad, but maybe only the riskiest, most gambling-est banks will get hurt, and everyone else will be ok? Well, not really. It gets worse.

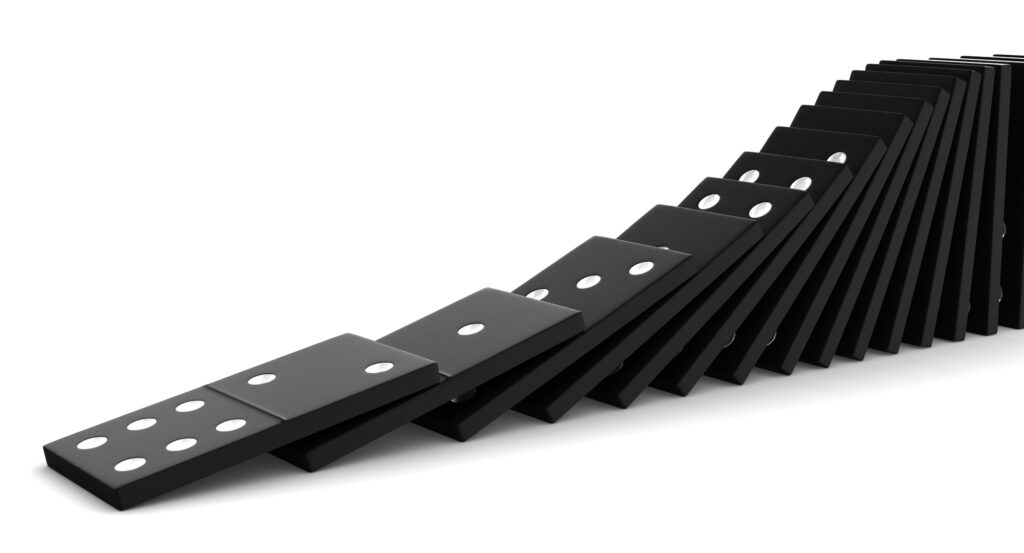

The hidden dominoes

The real trades that banks do between themselves, like fixed/floating swaps and synthetic derivatives, are way too complicated to get into here. But we can look at an oversimplified (yet still realistic) example just to see the main problem.

Say Alice makes a $1 billion derivatives contract with Bob, and she makes a slightly different $1 billion contract in the opposite direction with Charlie. The difference in terms between the contracts is what Alice is betting on to make a profit, as for example using 2-year bonds in one trade and 5-year bonds in another. The difference is small, so Alice uses a huge position size for each trade to make a worthwhile profit. Her gross exposure is massive. But because the two opposing contracts are the same size, as far as the rules go, the risk pretty much cancels out. $1 billion minus $1 billion is zero.

But here’s the trick. From Bob’s point of view, it doesn’t cancel out at all. He has a $1 billion contract open with Alice. So he hedges it with Dave. Charlie also hedges Alice’s contract, with Eddie. Dave and Eddie also have to go out and hedge their end, and so on. Of course this can’t go on forever because there aren’t an infinite number of banks. Maybe Dave and Eddie hedge with each other. But in the end, as different trades are originated and hedged, everyone ends up obligated to everyone else for really enormous amounts.

This is ok as long as no-one goes bust. If Alice goes broke, she defaults on her contracts with Bob and Charlie. They now have a billion-dollar emergency each. Bob and Charlie can’t simply match up their ends with each other, because they don’t know about each other (before 2008, swaps were traded in private over-the-counter deals). They must go into the open market and sell (or buy) to unwind their trades, taking big losses themselves and making waves, perhaps overwhelming normal buyers or sellers and starting a panic.

They have a word for panic spilling over from one financial institution to another, or one sector from another: contagion. Contagion is how financial crises start.

So, banks are gambling with leverage; using debt for collateral; their trades are vulnerable to counterparty risk; and if one goes down, it can trigger a chain reaction.

But wait, it gets worse.

Lies, damn lies, and statistics

Economists, like royal children, are not punished for their errors.

James Buchan

The amount of risk that banks carry is carefully monitored and regulated. There are only two small problems with that: banks don’t report everything to the regulators, and neither the regulators nor the banks truly understand risk.

The first problem is simple. Banks make money through risk. So of course the official picture they present is, like creepy Uncle Roger’s dating profile, somewhat more flattering than reality. As James Rickards writes, “Banks spent years creating special investment vehicles called SIVs to hide risks and avoid capital charges on consumer debt.”

Special Investment Vehicles and other conduits are used by banks to keep risky assets off their official balance sheets. But if the conduit itself gets into trouble, the bank that owns it has to take it over again, the deception is exposed, and the risk suddenly comes home.

The second problem, that the authorities don’t understand risk, is, incredibly, easy to prove. Wall Street and their regulators use a model called Value-at-Risk, which “assumes that risk is embedded in net positions”. In other words, if you have a massive sell trade and a massive buy trade, the net risks should cancel each other out. Most of this article has been spent methodically showing why this is just not true. Or rather, it’s true under normal conditions, but not when liquidity or counterparty risk is an issue—not in an emergency. Not for a Black Swan.

Speaking of black swans, the guy who wrote the book on these events (and why they actually come around more frequently than we expect), confirms from experience that current models of risk aren’t fit for purpose:

I worked on Wall Street for close to two decades in trading and risk management of derivatives. I noticed that while portfolio models got worse and worse in tracking reality, their use kept increasing as if nothing was happening. … Greed pushes bankers to take the maximum amount of “hidden risks”—those risks that do not show on a regular basis because the models miss it, but end up causing blowups.

Nicholas Nassim Taleb, Fortune, April 3, 2008

I came up with my own formulation to summarise what Wall Street (and the Federal Reserve, and the new regulator the Office of Financial Research) choose to ignore:

The risk to profits is in net positions. The risk to stability is in gross positions.

It also neatly explains why they ignore it. Here’s a more colourful version:

A man with his feet in the snow and his head in the fire is, on average, a comfortable temperature.

So, banks are gambling with leverage; using debt for collateral; their trades are vulnerable to counterparty risk; if one goes down, it can trigger a chain reaction; and no-one is on top of the systemic risk.

But wait, it gets worse.

All the money in the world

Maybe it wouldn’t be so bad if the risks we’ve looked at just applied to a few investment banks trading a small corner of the market. But, remember that massive wave of magic money that the banks multiplied? This is where it all went.

The latest (end 2020) total notional value of all derivatives was $582 trillion as tracked by the Bank for International Settlements (BIS). Some estimates put the real figure higher than $1 quadrillion. Given that banks want to downplay the size of their trades, we should probably assume that the true size is on the larger end.

If we were concerned with profit and loss, with fair-weather risk, we’d use gross market value, which is a mere $16 trillion or so. But as we’ve seen, worst-case risk—systemic risk — is proportional to total size traded, the bigger number. To be fair, we should probably count “trade size” differently for different kinds of derivatives. If you have that kind of time, go ahead. What we can say for sure is that the size of the derivatives market, for the purposes of estimating how risky it is, is somewhere between $16,000,000,000,000 and $1,000,000,000,000,000.

If it’s even halfway between those numbers, that’s still bigger than, well, anything else in the world.

To open an incredible graphic showing derivatives in context of all the world’s money, click here.

However you count it, investment banking trades total an unthinkable amount. It’s where all the money is. While it’s not clear exactly how big the derivatives market should be, if it was used for true hedging and not gambling, it would be a tiny fraction of what it is.

If the risk to this complex system were not really really well understood and controlled, because it forms by far the largest part of the global financial system, there’s perhaps no obvious limit to the amount of damage that can be done.

So, banks are gambling with leverage; using debt for collateral; their trades are vulnerable to counterparty risk; if one goes down, it can trigger a chain reaction; no-one is on top of the systemic risk; and the downside if it goes wrong is unlimited. But wait, it gets worse.

F*ck the law, if you can’t change the law

“I do not think you can trust bankers to control themselves. They are like heroin addicts.”

Charlie Munger, vice chairman of Berkshire Hathaway, interview with CNBC, 2013

The very word credit means “belief, faith” and derives from the Latin credere, “to trust”. But from a practical point of view, banks have proven time and again over centuries that they will risk inappropriately, lend irresponsibly, report inaccurately, print wildly, and generally cause chaos if we trust them to act without oversight.

In the 1920s, U.S. banks lent money to people who couldn’t really pay it back, and instead of keeping those loans and eating the losses and maybe resolving to be better at their job next time, they packaged up those bad loans, pretended they were a great investment, and sold them on—to their unsuspecting retail (ordinary Mom-and-Pop) customers. These and other unethical activities and conflicts of interest became big news in the Great Depression.

To restore confidence in banks, Congress passed the Glass-Steagall Act in 1933, which split banking into commercial (savings and loans) and investment (trading stocks, bonds, and other securities). This reduced shenanigans and was a Good Thing. It did, however, constrain the profits of big banks somewhat. And so it immediately came under attack.

From 1935 onwards, the restrictions of the Act were gradually weakened, sidestepped, or removed, until finally, in 1999, it was repealed completely. The UK and Canada had already ended their separations of investment and commercial banking a decade earlier, and so the new era of big-risk banking was really worldwide.

The following year, the Commodity Futures Modernization Act of 2000 was passed. In a few paragraphs, it put derivatives completely out of the reach of the regulators. How very modern.

Prior to 2000 … speculative wagers on prices could only be safely made on regulated exchanges. Congress overturned this centuries-old rule in 2000, making it legal for hedge funds, banks and insurance companies to use derivatives for speculative gambling, not just for true hedging.

Stout, Lynn A., “How Deregulating Derivatives Led to Disaster, and Why Re-Regulating Them Can Prevent Another” (2009). Cornell Law Faculty Publications. 723.

The stage was set. Banks could now do pretty much whatever they wanted.

But let’s add one last chug of petrol to that liberalising bonfire of regulations. In 2003 and 2004, the Securities and Exchange Commission reduced the capital requirements for broker-dealers (making those who deal in derivatives more vulnerable), and allowed more kinds of securities to be used as collateral, including mortgage-backed securities.

It should be obvious that balancing the upside-down pyramid of derivatives on a small sliver of debt that people are struggling to pay on their houses makes the whole system vulnerable to problems in the housing market. The next article, The Global Financial Crisis of 2008, should write itself at this point.

In the end, the laws got changed in the exact ways that allowed banks to make more and more money and the system to become less and less safe. I’m not saying that having billions of dollars allows for a lot of ways to influence politicians. But I’m not not saying that.

Do we need investment banks?

Investment banks perform a few useful functions. They help companies to do complicated administrative stuff, and someone has to manage large investments. But we don’t need them to be so big, to use so much leverage and such crazy derivatives, to keep their deals secret, and to write their own laws. We don’t need them to gamble like they do. We can’t afford it.

The first four articles have shown us how paper money, fractional reserve banking, central bank-led inflation, and gambling investment banks have built on each other to create a global financial system where money is unreal and risk is all too real.

But “risk” sounds a bit academic. What actually happens when it all goes wrong? Let’s find out in the next article.

🌍 Share this: