(Article first published Feb 25th, 2023)

Most people are uneasy these days, feeling that Something Is Wrong.

Normalcy bias, however, is strong, and so while we grumble, we still ultimately hope that our energy bills will forever be affordable; that shop shelves will always be full; that the Long Peace after WWII is a fixture of modern life; that the drug companies are looking out for our health; and that in these and all other areas important to us, things will stay or soon return to normal.

Nope. Sorry Harold, but none of those things are true. Hope is not a strategy.

Predictions are hard

As Mark Twain is supposed to have said, “Predictions are hard. Especially about the future.”

When so many huge developments have come as a surprise in the last few years, how could it be possible to guess what will happen next? And how would we know when to trust or to change our projections?

In this article I’ll try to predict the future using some fabulous tools that are almost entirely neglected in the downstream media, presumably for being too boring, or possibly too accurate: physics, history, and psychology. The great advantage is that this provides a solid basis for disagreement: if you don’t like some conclusions, all you need is a richer grasp of history, a reason why the trend should not continue, or a better view of the incentives.

Objects in motion

Newton’s First Law of Motion says that objects in motion tend to stay in motion until acted upon by an external force. Put another way, if you want to know where we will be tomorrow, see what direction we’re moving in today. What are the trends? Are they about to run me over?

Since money is time and energy made tangible, trends with more money behind them tend to be stronger. This is why “following the money” can also help show what might happen next.

History schmistory

History repeats her tale unconsciously, and goes off into a mystic rhyme; ages are prototypes of other ages, and the winding course of time brings us round to the same spot again.

The Christian Remembrancer, Volume 10, 1845

Individual people are quite different and unpredictable, but humans in the mass tend to behave in the same patterns. In the markets, This Time Is Different is the catchphrase that has ruined more investors than perhaps any other. In general, as Ray Dalio puts it, “All empires in history have risen and declined for knowable and measurable reasons.”

Hatters gonna hat

People do what they’re incentivised to do. This is so very obviously true that it might not seem worth saying, except that it does help explain why unintended consequences happen all the time. The Law of Unintended Consequences is also called the Cobra Effect, because when the British offered a reward for cobra skins in colonial Delhi to put paid to the poisonous problem, cobra numbers exploded instead, as the enterprising Indians were incentivised to breed them for the cash.

If you go to a surgeon, they’ll say you need surgery. Present the same symptoms to a herbalist, and they’ll give you herbs. I’ve literally seen this exact thing happen, and it shows that people tend to act out their roles, as well as doing more of whatever gets them paid.

Find out what it’s in someone’s interests to do, and that’s probably what they’ll do. Drug companies influence drug trials. Politicians cosy up to finance. Hatters gonna hat.

The Four Horsemen of the Apocalypse

Observing all of these tendencies gives us some powerful questions we can ask:

- What’s the trend (and what would halt the trend)?

- Has this (or something like this) happened before?

- Where is the money (or other incentive)?

But what shall we apply these questions to? How can we hope to eat the elephant of world events?

Maybe let’s start at the end.

In the final book of the New Testament, four horse-riders are unleashed on Judgement Day.

I looked, and there before me was a white horse! Its rider held a bow, and he was given a crown, and he rode out as a conqueror bent on conquest. …

Then another horse came out, a fiery red one. Its rider was given power to take peace from the earth and to make people kill each other. To him was given a large sword. …

I looked, and there before me was a black horse! Its rider was holding a pair of scales in his hand. Then I heard what sounded like a voice among the four living creatures, saying, “Two pounds of wheat for a day’s wages, and six pounds of barley for a day’s wages, and do not damage the oil and the wine!” …

I looked, and there before me was a pale horse! Its rider was named Death, and Hades was following close behind him. They were given power over a fourth of the earth to kill by sword, famine and plague, and by the wild beasts of the earth.

Revelation 6, New American Standard Bible

Naming the Four Horsemen is more difficult than naming all Seven Dwarves (I get lost after Dopey and Sleazy), because analysts disagree as to what they represent. But no matter. For our purposes, we don’t care if the “real” meaning is about the fall of the Roman Empire, and we don’t have to choose just four words. I take from this ancient cultural wisdom a few archetypal themes about what comprehensive disaster looks like.

- War. Armed conflict between countries; a straightforward meaning of the “conquest” of the rider of the white horse.

- Inflation. This is the literal meaning of the rider on the third horse. The food prices quoted by the rider with the scales are more than ten times what would have been normal in the Biblical era.

- Civil War. As distinct from a war of conquest, this is violent strife, the usual meaning ascribed to the rider on the red horse. Under here are contained civil unrest, insurrection, and secession.

- Famine. This effect comes along with the third rider: shortages of food, to which we moderns can add supply chain disruptions and power outages.

- Disease. Sometimes the first rider is called Pestilence and sometimes not, but it doesn’t matter, because Plague is mentioned by name at the end.

- Totalitarianism. Remember this is the day when everyone is to be Judged. To conquer is to defeat. Subjugation and non-negotiable judgement of all beings by a central authority sounds like the ultimate definition of dictatorship to me.

Not treated separately here are Death and Hades, which are implied consequences of all the rest.

War

🛤️ What trends in wars of conquest (not civil wars, revolutions, etc) have we seen?

In the last few decades, Western powers have only picked fights with countries that are small or have vastly inferior armed forces (e.g., the US is happy to roll into Iraq whenever a Bush gets bored, but not Iran, despite them being right next to each other in the dictionary and also on the map). The major military powers – the US/NATO, Russia, and China – have avoided attacking each other directly, preferring combat by proxy instead. China supports North Korea, and the US arms Taiwan (South Korea now arms itself). The worry with this trend is that tit-for-tat exchanges can drift thoughtlessly towards an escalation that drags allies into a hot war. This is most obvious in NATO’s proxy war in Ukraine, where Russia has warned that granting Ukraine NATO membership will definitely lead to World War III.

📕 What does history say?

Empires at the end of their lifespan may wage war aggressively in order to fool themselves, their enemies, and their citizens that they are still powerful – and to keep their militaries busy fighting instead of revolting. External wars become more likely when people choose “strongman” leaders, which they do when their society is in decline and experiencing internal conflict. Russia has only ever chosen strongman leaders, or had them thrust upon it. The United States is clearly an empire in decline at this point, showing all the classical signs of decay – currency debasement, soaring inequality, populism (the politics of I’m Right and You’re Deplorable), and moral collapse. Fighting between animals, among humans, and by states happens when competitors feel that they are about equally matched (this has been known for thousands of years and is called the Thucydides Trap). China, with much to prove yet not without its own problems, has been on the rise relative to the West.

💰 Where is the money?

Many think that the US adventures in the Middle East were really about oil, not democracy. Others say that reconstruction contracts going to Dick Cheney’s company show that it was really just another way of draining money from the taxpayer to the elites. While it’s true that there’s a lot of money in oil and infrastructure, there is really more money in money.

The petrodollar system is a large element of the post-war dollar reserve currency system, which is the biggest exorbitant privilege that the US enjoys. For many decades, all oil-producing countries agreed to sell their oil only for US dollars. This means the US can print dollars out of thin air and exchange them for oil and other real goods and services, which gives them an artificially high standard of living which they want to maintain at all costs. Mainstream commentators say that the reason that the oil market in particular, and no other, is completely distorted in this way (no-one says you have to buy cocoa in Colombian Pesos, or Viagra in Vietnamese Dong) is simply that the dollar is easy to trade with. If that were the only reason, all commodities would be traded exclusively in dollars. But they’re not.

So what other reason could there be? While the system may have started as a cosy deal between America and Saudi Arabia, these days it’s a lot less friendly. Let’s look at what happens to those who don’t wish to play the petrodollar game.

In 2000, Saddam Hussein blackmailed the United Nations (on the threat of stopping exports) into allowing Iraqi oil to be sold only in Euro, not US dollars.

In 2003, a US-led coalition invaded Iraq, alleging that Iraq had weapons of mass destruction (they didn’t), and killing Saddam Hussein. No Euros for you.

In March 2011, France began enforcing a no-fly zone over Libya for “humanitarian” reasons. Not really any of their business, one might think. But around this time, a since-leaked email to then Secretary of State Hillary Clinton had identified Libya’s huge gold and silver reserves, along with Muammar Gaddafi’s plans to use them to implement a new, gold-backed currency, as a threat to France’s African interests. Since such a pan-African currency would have allowed Libya to effectively sell oil for gold instead of dollars (which Gaddafi was allegedly agitating for); this was also a clear and present danger to the petrodollar system.

In October 2011, following months of NATO bombings to support proxy militias, Gaddafi was killed. The West lost interest in the wellbeing of ordinary Libyans. The gold-backed currency never appeared.

And how is the precious petrodollar system doing these days?

Not well. In March 2022, Russia, in response to Western sanctions, proposed taking payment for its oil and gas in rubles, gold, or Bitcoin, and in September 2022 agreed to sell oil to China for Chinese yuan. In October 2022, the BRICS countries announced they were “actively researching” how to create their own reserve currency (a process that started after the 2008 Global Financial Crisis and arguably is a contributing factor to the conflict in Ukraine). Why this is a big deal should by now be obvious – yet it was hardly written about at all in the West. These countries are rich in commodities – real stuff – which they plan to use to stabilise their currency, as opposed to the US dollar and all its imitators and dependants, which are balanced precariously on debt and leverage.

It gets worse. In the summer of 2022, the Eurasian Economic Commission proposed “a new international standard for the precious metals market – Moscow World Standard”. This seemingly irrelevant announcement, utterly unreported in the West, in fact aims to destroy the precious metals price-fixing scam run by London and New York.

Gold and silver would be repriced to fair market value, which is many multiples of current prices. Not only would this shift the balance of financial power towards the East, which has been stockpiling much more gold than it will admit, but it could even trigger the collapse of the entire Western financial system both by liquidating the commercial banks which have been sitting on the price, and more importantly, by de-legitimising fiat currency in comparison to gold, which has always been real money.

While the Eastern powers seem to wage or threaten war for historical or ideological reasons – to regain previous territories or to maintain a narrative of empire – Western powers have no problem waging wars to prop up currency systems. Therefore, to the ever-present threat of war between Indian and Pakistan, China and Taiwan, and Russia and NATO, we must add the wildcard of Western wars to enforce currency regimes.

In case it needs to be said, the citizens rarely vote for war, although they may be propagandised into supporting it once the decision has been taken by politicians, arms companies, the Deep State, or whoever it is that really runs things. War is a product of centralisation of power.

In the very near future, we will likely witness the collapse of not only the petrodollar system and the US dollar as global reserve currency (which event on its own would wreak unimaginable damage on the global financial system), but most other fiat currencies too (see Inflation, below) and a battle to replace them. Central Bank Digital Currencies (covered under Totalitarianism), either backed by gold (in the East) or by nothing but force (in the West) will compete with decentralised cryptocurrency and, perhaps, a conventional gold standard. There is no reason to think that any such transition will be orderly or peaceful.

Inflation

🛤️ What’s the trend?

There’s a lot to say about the nature of money and how it’s been debased throughout history, which is a central theme of my History of Money series. The most important trend to understand, though, is also one of the hardest, just because of how insane it is. Our current monetary system is exponential.

Governments all spend more than they steal – I mean, earn. They make up the difference by borrowing money (selling their debt in the form of bonds) or printing it, or some modern alchemy that amounts to the same thing. But here’s the trick. The more they borrow, the more interest they have to pay. Since they can no more balance a budget tomorrow than they can today, they always owe more in the future, have to pay more interest, and so it goes on. So the money supply always increases – the real meaning of “inflation” being inflation of the currency supply. New money then has to be created or borrowed in order to service the greater interest on the larger debt. This incurs more costs, and the result looks like a straight line up close and a parabola when you step back.

Here’s the interest that the US government is paying:

For the US government in particular, since the “Federal” “Reserve” is a private company, printing money itself, unbelievably enough, incurs interest. See this video from the excellent Peak Prosperity Crash Course for an explanation of the US money-creation system, which, like it or not, is the dominant global economic factor now. Although central banks differ by country, they’re all now using the same models and assumptions, and many of them (notably England and Japan) have recently been buying government bonds as if there could be no consequence (if you think that selling your own debt to yourself sounds like cheating, you have more sense than our leaders).

Exponential or parabolic trends always hit some constraint and end badly. It’s inevitable.

Psychologically, the trend is that the man or woman in the street has less and less idea of what the central planners are or should be doing. They just want the things they need (food, rent, energy) to be affordable. But the more money you create, the less it’s worth. The more money they print, the higher prices will go.

An important business trend that I’ll make the case for under Famine is the undoing of the last 30 years of globalisation. For now, I’ll just note that prices of not just food, but pretty much everything, will increase dramatically and systematically in the next few years.

📕 What’s the precedent?

Every currency that has ever ceased to be redeemable for gold or silver has then been inflated by the State until it implodes (for just one quick example, see the story of the Banque Royale). That’s as much financial history as you need to understand where we’re headed. Now recognise that all major currencies in the world today have ceased to be redeemable for gold or silver, starting at most 52 years ago. Statistically, we’re about 12 years overdue a collapse (or, “reset”).

In the article A Brief History of Global Financial Resets, I’ll write properly about one particular catastrophe, the Weimar hyperinflation of 1920s Germany. For now, it’s worth noting that the main conditions that caused it are also present in Western countries today:

- A stated willingness to do “whatever it takes” to support the economy

- Inability to admit that increasing the currency supply increases prices. Witness the half-a-trillion-dollar spending of the insultingly named Inflation Reduction Act, given intellectual cover by the untested Magic Money Tree – sorry – Modern Monetary Theory if you doubt this.

- A huge Social Security drain on the taxable classes. Then, this was mass unemployment benefits for striking Ruhr miners; today it’s the ever-expanding ranks of those unwilling or unable to work (in the US in 2021, conservatively, every two working people supported one person on Social Security; in the UK, more than half of the population now receives more money from the State than they pay in tax).

- Supply chain problems, especially energy (then having to import coal, now underinvestment in oil and gas).

- Special interest groups that actually benefit from currency inflation. Then it was industrialists, now it’s the financial and political classes.

- Strikes. The German hyperinflation was much worsened as workers demanded, not fiscal responsibility, not an end to the insane money-printing, but to be paid more currency units, making it politically impossible to slow down the debasement. This is repeating itself now.

- Crippling debt (then, reparations for WWI, now, out-of-control national debts fuelled by deficit spending).

There are some big differences, of course, and here’s one. While Weimar Germany did roaring trade exporting subsidised goods to, and importing energy from, other countries that were functioning, and her citizens tried to preserve some wealth in foreign currencies that were not going through hyperinflation, when the fiat experiment reaches its inevitable end, it will happen to every Western country all at once.

When the causes are present, the result appears. We will eventually get destructively high inflation (probably the worst type of all, hyperstagflation) unless the factors in the list above reverse. Go through the list and see which of them are likely to improve anytime soon. I count none.

💰 Where is the money?

Inflation is ruinous for savers, for the fiscally prudent, for the working man, for those with mouths to feed, and especially for those on fixed incomes such as the retired. But who benefits from inflation? Debtors and speculators.

Debtors get to pay their debt back in money that is worth less than the money they borrowed, which for them (but not their creditors) is brilliant. Governments are the biggest debtors by far. The political class is thus naturally incentivised to create inflation. In case it hasn’t sunk in yet, this means that by definition, under a debt-based money system, the government’s interests are opposite to those of the governed.

Speculators can benefit from investing in the types of assets into which newly printed money flows. Under normal inflation, such assets tend to be financial assets that can be traded by institutions, like publicly traded equities (this is the real reason that “stocks only go up”). The financial class, which is very cosy with the political class, wants inflation just as much as they do.

In high inflation, hard assets and the companies that produce them appreciate in value. Ordinary folk, who don’t have access to large amounts of other people’s money, generally fail to benefit from the upside of inflation, while being either slowly robbed of their value or quickly ruined, or both in turn.

Politicians and bankers grow fat on the constant drip of inflation of the money supply. Under normal circumstances, they don’t want a flood of high inflation, which would make them tremendously unpopular. They prefer to bleed the productive classes quietly, unnoticed. But these are not normal circumstances. We are coming to the end of a 50-year funnel, where the financial powers must choose between complete collapse and hyperinflation. I explain why they have to choose in my article The Fed Funds Rate: How this one stupid number is about to ruin your life, but suffice it to say here that throughout history, governments in this situation always choose to print more money.

Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens … While the process impoverishes many, it actually enriches some … Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

John Maynard Keynes, The Economic Consequences Of The Peace, (1919)

Inflation, one of the greatest hidden evils of civilisation, is entirely a product of centralisation. It’s only possible when a central authority controls the money supply. Hyperinflation is only possible when the Experts are truly running the asylum.

The actual mechanisms of inflation are much more complex than the simple picture I’ve drawn here, but that doesn’t make it any less true. We will, I think, get terrible deflation (crashes of various markets) in the near term and terrible inflation (debasement of currency) in the long term. It’s not about prices. It’s about value. The things you need will cost more (if you can get them), while the assets you have will be worth less (if you still have them).

Civil war

Under the heading of civil war I’m also lumping the lesser evils of civil unrest, insurrection, and secession.

🛤️ What’s the trend?

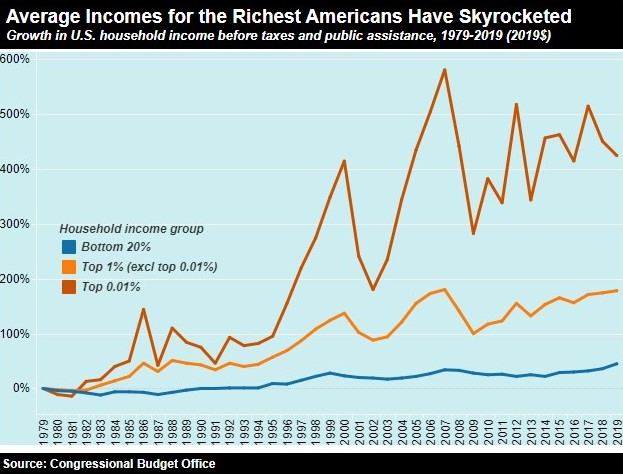

Society is becoming more polarised. The United States is perhaps the most advanced case among industrialised nations, although signs are visible everywhere. Income inequality makes the majority of people (who by definition have “less”), angry. The American rich have been getting richer much faster for the last 40 years.

Half of Americans think they’ve already seen an “insurrection”. People are talking seriously about Texas or Florida seceding from the Union, as the flight of conservatives from Liberal states continues. The country is splitting along political lines. Across the Atlantic, the United Kingdom has already seceded from the European Union, and speculation has been rife since about which other country will be the first to follow. Within the UK, Scotland has been very vocal about its own prospects of seceding. As trust in governments continues to melt away, fiat blocs are more vulnerable to breaking up.

When times are good, or when there is a clear common enemy outside the gates to focus on, people band together. When times are bad, and they’re not quite sure why, people point the finger at each other. According to the Edelman Trust Barometer, in 2022, 64% of respondents from around the world say people are “incapable of having constructive and civil debates about issues they disagree on”. This tendency to distrust, made worse by the absence of a balanced media, makes society more likely to fragment along political (Brazil right now), racial (Marxist Lives Matter!), or religious (same as it ever was) lines.

📕 What’s the precedent?

In recent years, there’s been civil unrest because of failure to provide adequate pensions and healthcare (Chile), against totalitarian government (China), due to inflation (Argentina), high food prices (Iran) and many more reasons. As this article attempts to show, pension solvency, totalitarian government, inflation, and food affordability are all about to get much worse. Therefore, civil unrest will get much worse.

I was in London for the Poundland riots of 2011. The police (rightly or wrongly, at least understandably) shot dead a criminal who had been carrying an illegal firearm, and members of the subsidised classes (the often-used label “deprived” is mathematically the opposite of how that works) decided to burn shops and cars belonging to taxpayers who had nothing to do with it, and, famously, steal things from Poundland, because sOcIaL jUsTiCe. The point is that as the moral fibre of society deteriorates, the threshold for civil unrest gets lower. Do you think that moral fibre is increasing in society? If so, I want to live where you live (or perhaps smoke what you’re smoking).

Some causes for serious civil disorder – economic problems, currency debasement, disruption to the food or other supply chains – are inflicted on us by central planning. Others, such as religious and cultural antagonism, moral deterioration, and fragility of public discourse, are our individual failings writ large. In the end, civil unrest is a product, a symptom of decay in the dark.

💰 Where is the money?

Where is the money, indeed.

In the US, social security will be completely broke within the next decade (they admit this themselves and don’t seem to have a plan for it). At the state level, unfunded pension liabilities as of 2022 were $8.28 trillion, or nearly $25,000 for every person in the country, and getting higher.

In the UK, the central bank recently had to buy the government’s debt to stop the declining bond market from causing UK pension funds to collapse. Why were they at risk of collapse? Because they had no choice (in an ultra-low interest rate environment) but to bet on the bond market with huge leverage in order to try to keep their promises of providing for old people. The “cure” itself causes other problems, and it won’t keep working forever. Meanwhile, socialised healthcare is burning money faster than ever and still not fit for purpose. While writing this article, I tried to get two prescriptions filled, and to get urgent medical attention for someone, and failed each time. Others are far worse off, with newspapers reporting several people dying while waiting hours for ambulances to respond to serious emergency calls. I distinctly remember thinking “This is what [the start of] civilisational collapse looks like” – when you’ve funded a service, you genuinely need it, but still can’t get it.

The truth is that there is nothing special about pension funds, or any of the other state or private resources that we expect to be there when we need them. They’re forced to speculate with our money in order to turn the mandated profit; they waste resources; they’ve been weakened by decades of mismanagement of themselves and of the economy; they depend utterly on a morally and literally bankrupt monetary system; and in general they will go down – are now going down – with the ship.

Several years ago, I wondered, as I walked past a group of working-age men sitting around on a bench on a Wednesday afternoon choosing to get extremely high instead of supporting their families or contributing to society, how thin the thread was that kept them from expressing their obvious energies and frustrations in less passive and dead-end ways. Just what would happen if they couldn’t afford to self-medicate? I concluded the thread was delicate, and moved out of that neighbourhood, for good.

So I ask you the same question: How long do you think civil society will remain civil when people cannot be paid their unemployment money, or their pensions, or get healthcare?

Famine

In Ye Olden Times, ensuring energy security meant collecting firewood, and medicinal herbs grew locally. The critical supply was food. These days, a serious break in electricity supply, logistics, or even the internet could disrupt society up to and including deaths among the vulnerable. So, “famine” for moderns is lack of essentials, and we can consider supply chain disruptions and power outages, as well as lack of food.

🛤️ What’s the trend?

More and more of us are living in cities (three-quarters of the world population already in 2015), meaning, separated from the original supply chain of the field, wood, or garden, and ever-more reliant on longer and more complex ones.

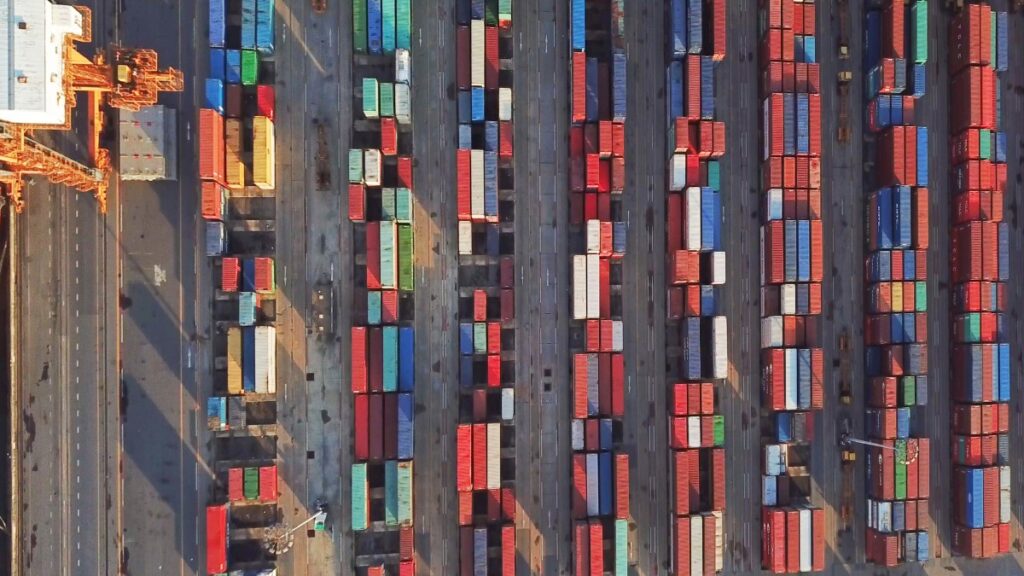

Starting with the rise of China as a global manufacturer and exporter around 1990, the entire global supply chain has been relentlessly optimised for lower cost. Manufacturing moved to countries with lower wages. Raw materials, components, and finished products were sourced from wherever was cheapest, which was often halfway around the world. Companies cut the number of suppliers to take advantage of bulk cost savings. The many variants of just-in-time inventory management cut stocks everywhere to the bare minimum. If, in hindsight, having seen a few bare shelves recently, you’re thinking that this sounds like a recipe for fragility, you’re right.

It’s also a recipe for complexity. Each supply chain has its own inputs, and thus depends on its own supply chain, and so on into, for all intents and purposes, infinity. The meta-supply chain, as Jim Rickards brilliantly explains, is not merely complicated, but complex, in the way that crowds, markets, a pre-avalanche snow pack, or the weather are complex.

The unpredictability and fragility of complex systems increase exponentially as a function of size, not linearly. After a certain size, which the meta-supply chain has arguably passed long ago, disruptive, uncontrollable events become not just likely, but inevitable. The frantic computerisation of logistics attempted to keep a lid on this with predictive analytics and artificial intelligence, but it is still just a matter of time. Was still just a matter of time.

The unravelling of the global supply chain has already begun. It started in 2018 with the trade wars between the US and China, which rerouted huge amounts of shipping. It accelerated with the restrictions imposed on business by governments in response to Covid. It hit headlines again with the outbreak of war in Ukraine. But these things are triggers, not causes. The cause is the increased complexity and over-optimisation of the entire system over decades.

The things that have broken so far are not easily put back together. We can’t simply patch up the system; we must re-form it.

For example, the shortage of truckers caused by young men not wanting to enter a profession where robots will surely displace them in a few years is a real problem not easily solved. With ports already at capacity, when supply routes change due to global political shifts, as they will continue to do, building new ports or significantly expanding existing ones takes years, if environmental regulations even allow it at all in the locations where it’s needed.

If any single part of the meta-supply chain gets blocked, the effects can hit every other part. A shortage of diesel, of truckers or trucks, of port capacity, of fertiliser, or of ammonia to make fertiliser, or of any one of an uncountable number of other things, can cripple the whole thing.

For example, a single company, Taiwan Semiconductor Manufacturing Company Ltd, makes 90% of all advanced microchips in the world. They are planning to move manufacturing to the US. If China invades Taiwan before the new plant is built (which will take years), this would halt manufacturing of most cars, phones, PCs, and military weapons worldwide. Similarly, if China and Russia, who produce most of the world’s gallium, which is used in the chip manufacturing process, decided to stop supplying it to their political enemies, this could also massively compromise the making of microchips. Since every part of every supply chain is controlled by computers, from the truck engines to the supermarket stock control systems, the potential disruption is unlimited.

To summarise this trend, efforts to fix the global supply chain by “inshoring” or “friendshoring”, like the move of Taiwan Semiconductor, which are now being planned by all advanced countries, and by adding back stocks and slack, alternatives and reserves, will likely take the best part of a decade, and permanently decrease efficiency even as they increase resilience – and cost.

What about trends in energy?

The captive media would have us believe that everything was fine and the only reason that Germans were stealing wood from the forests (and Poles burning rubbish) to stay warm in the winter was because Putin cut off gas supplies to Europe. In fact, decades of ideological opposition to both fossil fuels and their lowest-carbon replacement, nuclear energy, have finally given their inevitable result.

In 2019, Germany committed to deactivating all 84 of its coal-fired power plants, and then promptly started blowing them up.

Two years later they started decommissioning half of their nuclear power plants. This is not an isolated trend but part of a global movement called “You Will Freeze In The Dark” – sorry, I mean “Net Zero”. I could collect statistics showing the underinvestment in fossil fuels and nuclear energy, but perhaps Net Zero is an established enough mainstream narrative by now that we can take it as read that governments are actually following through on it. Predictably, one of the main problems with replacing coal, gas, and nuclear power with wind and solar is that the former can be switched on and off on demand, whereas the latter are erratic and seasonal. The result is poor energy security and, eventually, guaranteed blackouts.

Speaking of poor security, there is an interesting recent trend regarding food security.

As I was writing this section, New Zealand’s largest egg farm suffered a serious blaze in which 75,000 hens died. That might not sound like very much, but just as with everything in the supply chain, it’s the effects on the margin that are important. If the people in an imaginary town eat 1,000 eggs a week, and the supply is, say, 1,050 eggs a week, everyone can buy eggs, and a small percentage goes to waste. If the supply drops to 900, even though in theory it doesn’t seem like a big deal, in practice the shelves are soon bare, and stay empty, and a whole host of psychological and regulatory effects follow. In short, it doesn’t take much to create a shortage.

A few Kiwis short of an egg sandwich (which is my new favourite insult) would not be noteworthy, except that the same thing is happening all over: lots of large food processing plants are catching fire for no apparent reason. At the bottom of this article is a list of such incidents in the US in the 18 months from Jan 2021. Bizarrely, the combination of government intervention and accidental damage seems to be disproportionately affecting eggs in particular, which is unfortunate, because eggs are incredibly good for you and also might literally cure Covid. At the same time, while we are not making new farmland, we are decommissioning it for Net Zero/Freeze-In-The-Dark purposes and by covering it with solar panels.

(A couple of days after I finished this section, I found an article in the newspaper:

The author is a farmer, and here’s a tip: if you want even a slim hope of getting something other than a pre-approved narrative fed to you by the mainstream media, look for guest writers; they’re often people with real achievements outside of journalism, and have something of their own to say. These pieces, and, if they’re allowed, the comments sections, can be very interesting.)

The trend, therefore, is firmly in the direction of less food production (for more people), even without other factors.

But there are other factors, foremost among them fertiliser. The same supply chain effects we discussed above, especially natural gas and war, have played havoc with the price and availability of fertiliser, on which all industrial agriculture depends. As this US government report says casually: “The impact of fertilizer prices could likely take a heavier toll on 2023 agricultural production.” To put it more realistically, since higher input costs cause either higher output costs or lower production, and much of the world’s population doesn’t have any spare money or spare food, a doubling of fertiliser prices (which has already happened) means someone is going to starve this year.

If you don’t believe me, here’s the Executive Director of the United Nations World Food Program saying the same thing:

📕 What’s the precedent?

The thing about the modern meta-supply chain is that it is unprecedented in size and complexity, which is what makes it fragile and unpredictable. But poorly functioning supply chains have certainly made historical disasters, such as the Irish Potato Famine, and Spanish Flu, much worse, so we can expect ongoing supply chain degradation to weaken our responses to any future natural or man-made disasters.

💰 Where is the money?

To even ask who might be incentivised to cause famine is to immediately enter the realm of conspiracy theory. It’s true that there are influential individuals and groups who have publicly stated that we need to reduce the world’s population to a fraction of its current size. Some of them even carved a target number in stone (about a 94% reduction from current levels). How much of an impact even the most sociopathic of elites could have on the factors we’ve considered is debatable: some of them certainly are subject to government interference and long-term policy, while others seem to be part of the sweep of history.

The way that the Masters of the Universe and their lackeys have manipulated money, however, is unquestionably a factor in causing a potential crisis. Strong inflation (always and everywhere a product of currency debasement) can cause a food crisis on its own, even in the absence of other factors, as this article describes.

Deliberate or accidental, insecurity follows from centralisation. The food supply is vulnerable to mysterious fires precisely because it relies on large processing plants. Fertiliser is such a problem because massive farms have taken over from traditional small-scale mixed-use growing of animals and vegetables, which feed each other naturally. Inflation is, as we’ve seen, a phenomenon of authority. Wars, kinetic or trade, likewise issue from government fiats. Subsidies that pay for farmland to be used for anything other than farming come not from the free market, but the imposition of a one-size-fits-all ideology (robbing Peter to starve Paul, as it were). Apart, perhaps, from the sheer underlying complexity of the meta-supply chain itself, all the factors we’ve discussed are created or worsened by centralisation.

Disease

🛤️ What’s the trend?

One fairly hefty trend is that we are getting fatter. The average adult in 2016 was three times as likely to be obese compared to the average adult in 1975, and that trend is not slowing down. Obesity is the result of a fundamental imbalance of hormones (brought on by the wrong types of food), which affects every cell in the body, making one weaker and more vulnerable to disease. The obese were vastly over-represented in the fatalities from Covid, and will be again when the next Scary Thing comes along, natural or manufactured.

Not coincidentally, food is getting less nutritious. Processed and ultra-processed food used to make up less than 5% of the American diet in 1800, and makes up a staggering 60%-plus today. Soft drinks, chemically recovered seed oils, hydrogenated fats – this stuff is not food. Industrial food substitutes displace real food in the diet, and, surprise surprise, intake of them correlates very well with occurrence of the diseases of civilisation. But even if you can find and afford real food, you’re still getting fewer nutrients. The vitamin and mineral content of vegetables has declined over the last several decades, in some cases by as much as 50%.

As a result of these trends, two billion people are categorised as suffering from “hidden hunger” because they are undernourished in terms of vitamins and minerals. According to some studies, almost 100% of us suffer from nutritional inadequacies of one form or another. And that’s according to the ridiculously low official guidelines on the amounts of vitamins and minerals that we need to avoid clinical symptoms, not to achieve radiant health.

📕 What’s the precedent?

The most recent public health precedent is Covid. I’ll have more to say about this in its own article series in due course, and also below under Totalitarianism, but for now I just want to point out one consistent dimension to the response by authority. Masks, vaccines, antisocial distancing, lockdowns, red zones – these all focus on external prevention rather than internal health (a vaccine is an exogenous intervention in, rather than a natural strengthening of, the immune system). They all define the locus of control outside of oneself.

Louis Pasteur, father of germ theory and vaccination, had a long-running disagreement with Claude Bernard, who held the rival microzymian theory, according to which the body is not a sterile battleground, the presence of a germ in which causes disease, but rather an ecosystem of microorganisms in which disease appears when a deterioration of the body causes existing microorganisms to turn pathogenic. While some elements of microzymian theory have since been confirmed, Pasteur’s alleged deathbed confession, “Bernard avait raison. Le germe n’est rien, c’est le terrain qui est tout,” would seem to be going too far. The obvious truth, recognised by both common sense and modern research, is that both the presence of pathogens (or other stressors) and the physical and emotional state of the patient are critical factors in the development of any disease.

And yet, in the monolithic response to Covid, authorities spoke, acted, and legislated as if the germ was everything and the terrain was nothing. Any factor that would help explain why one person got very sick while another did not, in the presence of the same virus, was downplayed if it could not be outright ignored. One’s Vitamin D status, one’s aforementioned ratio of muscle to fat, level of physical activity, and general health all make a huge difference as to whether the same disease is dangerous or harmless to us. And these things are, to one degree or another, under our control (and have only positive side-effects). While trillions of dollars were spent on propaganda, vaccines, lockdowns, and other outside-in measures, how much was spent on encouraging us to exercise, eat better, and get some sun? I didn’t see any at all.

Whatever the next health crisis is, we can already predict from this precedent how it will be handled. The locus of control will again be presented as being outside of ourselves, which is profoundly disempowering (ironically, feeling disempowered suppresses the immune system). Salvation – survival – will reside in experts, in pharmaceuticals, in governments, in compliance. This is not a recipe for resilience and health.

💰 Where is the incentive?

Yes, some people got rich from vaccines, but money is not the real incentive here.

Health is now about control.

Being made, in the name of public health, to stay at home or within a designated zone is control of freedom of movement. Not being allowed to see your friends and relatives is control of freedom of association. Censorship of data and conclusions not part of an approved narrative is control of freedom of speech. Being nudged, threatened, or shamed into having a medical procedure is control of bodily autonomy. Masks are nothing but a visible symbol of compliance with these controls.

But that wasn’t enough. The authorities didn’t just give us advice, like a big brother would. They tried to track as much as they possibly could. Whether it was your location from cell phone data, your compliance through snitching apps, or your medical data via vaccine passports, every effort was made to digitise, centralise, and control your data – and through it, you. Like Big Brother would.

Who is incentivised to control the populace? Every government and every major political party, firstly. Many bureaucrats and the departments they work for, given a chance. And of course, unelected organisations. For some reason, those with no accountability seem to thirst the most to impose their I-know-better-than-you attitude on the rest of us.

Just because the World Health Organisation has the word “health” in it does not make them your friends. This is the agency that heaped praise on the murderous Communist Chinese government’s response to Covid, which, if you recall, included reporting “no evidence of person-to-person transmission” in January 2020, disappearing whistleblower doctors, and, in all likelihood, destroying evidence that their lab created it. This public praise was actually doublespeak, to try to encourage more cooperation from China, making it politically motivated misinformation. The WHO also pushed back hard against anyone that dared call this flu virus that came from China “Chinese flu”. After a whitewash initial visit to Wuhan, they refused to conclude where the virus came from, and recently quietly dropped any pretence to investigate. The “World” Health Organisation also refuses membership to Taiwan, which tells you something about their bias.

Among the WHO’s other achievements in the fight for truth is its leader unilaterally declaring monkeypox, a rare disease with a fatality rate of 0.03%, a global health emergency, against both common sense and his own expert committee, and calling for censorship of anyone saying monkeypox was a gay disease, despite admitting in the same statement that 98% of transmission is between men who have sex with other men (the other 2%, presumably, being a little too fond of monkeys).

This same group of biased, self-contradictory, politically correct, lying unelected bureaucrats now want to police misinformation worldwide. You could not make this up. They are voting on a treaty that would bind, under international law, almost every country in the world into censoring information just because the WHO says so.

All of which display of centralised control leads us nicely into the last theme…

Totalitarianism

The well-being of humanity has always been the alibi of tyrants, and it provides the further advantage of giving the servants of tyranny a good conscience.

Albert Camus

🛤️ What’s the trend?

If there’s a clearer trend than the rise of totalitarianism I don’t know what it could be. Every step taken by governments these days is in the direction of increased control, monitoring, censorship, restrictions, and conformity of thought. Always, of course, for our own good.

When I was a child, I remember my parents getting letters in the post that had obviously been opened and resealed. Being members of a peaceful environmental organisation was enough reason for our democratic Western government to spy on them.

These days, however, no-one needs to open any envelopes. State intelligence agencies just scoop up our emails and electronic messages en-masse, store, and analyse them.

At this point, many good citizens are probably thinking “So what? They do this only to protect us from terrorism/viruses/climate change/incorrect pronouns/insert cause du jour.” Yes. Thinking in principles is hard. But here’s a shortcut. Whichever party or leaders you like, imagine the other guys coming into power. You know the ones, with unethical ideas, corrupt values and dangerous policies. Now those rogues can use the existing laws and data, or push for even more, and use all the minutiae of your life, your aspirations, affiliations and confessions, to suppress and discriminate against you. Not so much fun now, is it?

States, even in the “free” world, have long monitored their citizens’ messages, financial transactions, movements in and out of the country, and much more, but didn’t do much with it.

Until Covid.

Suddenly, and without any democratic process, governments around the world tore up the social contract and unilaterally removed the possibility of their citizens to move freely, to see their newborn babies or dying grandparents, to wear what they want, to go to work and to keep their businesses running. At times we weren’t even permitted to sunbathe, or walk on wet sand at the beach (dry sand being deemed permissible). In many places the principle of informed consent to medical procedures, central to bioethics since the Nuremburg Code was drawn up after the Nazi medical horrors of the Second World War, was thrown out without debate. That most foundational of all freedoms, freedom of speech, was attacked everywhere, with ordinary citizens, medical experts, and elected representatives alike finding themselves unable to debate or even to question what was being done to them, lest they be derided, deplatformed, defunded, or dismissed.

They tried to marry the twin evils of constant monitoring and state restriction by introducing Covid passports, with varying degrees of success in different countries.

But it was a Black Swan, an exceptional, desperate-times-desperate-measures type thing, wasn’t it? They repealed all those “emergency” regulations that enabled this wholesale, indiscriminate use of State force, that allowed a rush-tested medical product to be aggressively pushed on billions of people, and, not coincidentally, that protected the drug companies from being sued for side-effects, as soon as most of us got The Virus and survived. Right? Right??

Or did they put that handy precedent in their back pocket and just move on.

Which of those was it.

Now, even if you think Covid was the new Ebola, the vaccines are safe and effective, and locking us all up was a necessary evil, my point still stands. The big change is that, justified or not, we were all forced to accept a new, materially different relationship with the State, which is not to our favour.

What is the principle here? In the New Normal, you don’t have any rights except those that the government allows you to have, for the period that its Experts in their sole discretion allow you to have. That means, properly speaking, that you no longer have any rights. You just haven’t noticed yet.

One who seeks to achieve freedom by petitioning those in power to give it to him has already failed. To beg for the blessing of “authority” is to accept that the choice is the master’s alone to make, which means that the person is already, by definition, a slave.

Larken Rose

And what are governments doing with our new, ratcheted-up level of acceptance for being controlled? Continuing the trend, and finding new things to control. The next enemy is “misinformation”. Not government misinformation, or drug company misinformation, of course, of which there’s been rather a lot lately. But rather, any WrongThink from citizens that differs from whatever The Truth is this week. The US felt the need, bizarrely enough, to use the Postal Service to spy on its protesting citizens, perhaps because its dozens of Praetorian alphabet agencies were busy spying on ex-presidents. Meanwhile, the UK government, always playing catchup, has only recently created its own secret thought-police department. Germany is happily prosecuting thousands of people for the delightfully vague non-crimes of “hate” and “insult” on social media. New Zealand, following in the glorious footsteps of the Stasi, is encouraging citizens to inform on each other by framing disagreeing with the government, insisting on one’s rights, or indulging in “conspiracy theories” as precursors to terrorism. And apparently everyone is fine with all that.

If all this is indeed part of a deliberate movement for more control and less freedom, expect them to try to take away your encryption next. Really. Run a search; follow someone; keep an eye out. Encryption is the last defence against totalitarianism. If they leave encryption alone, and don’t introduce new laws to restrict speech online, I’ll happily admit that this trend has changed.

📕 What’s the precedent?

While the technology for controlling people so completely has never existed before, slavery certainly has. History shows that if one group has a monopoly on force, they can keep the rest as slaves for centuries at a time. In the modern age, the State has this monopoly: it allows citizens to possess weapons only grudgingly or not at all.

And how would it look if a State truly decided to exercise this power on all of its citizens at once? Well, China has kindly run that experiment for us, so that we can see our own totalitarian future. There’s so much abuse by the State to choose from, I’ll just quickly pick a few examples at random.

China already has the Covid passes that were so hated in the West. If your QR code is red they will literally cart you off or drag you off to quarantine with your tiny children. Since the QR codes can be changed centrally, individually or by region, the government can also use Covid as a cover for crushing dissent. Neat!

Robot dogs enforce – sorry, encourage lockdowns and now can also carry machine guns and be dropped off by drone for no reason.

And of course the master plan is to control literally everything in one Social Credit Score system, rewarding citizens who do and say what they’re told and punishing those who don’t.

China is the nation that has removed the most freedoms from the greatest number of citizens in history – and they’re just getting started. An appropriate response might be fear or loathing. Yet Klaus Schwab, the leather-faced leader of everyone’s favourite group of unelected elitist busybodies, the World Economic Forum, recently praised China as a “role model”. Unfortunately, the views of Anti-Santa Klaus matter, because his WEF inserted Trudeau, Ardern, and many other of their operatives – sorry, Young Global Leaders – into prominent political positions around the world. Not coincidentally, those “leaders” are leading the way in introducing totalitarian legislation in sheep’s clothing. If you want to see what the 0.001% plan for the rest of us, simply listen, and they’ll tell you. They just can’t help their little selves.

In China right now, restrictions seem to run on QR codes, which is a bit clumsy. Of course, the ideal system is programmable State money. Why force passengers to scan a barcode on their phone to get on a bus when you can simply block them paying for transport – or food, or anything else – digitally.

If you ‘re thinking “That could never happen here”, do pay attention to this next part.

💰 Where is the money?

When the truckers staged a protest in Ottowa (against Trudeau’s mandatory vaccination of truck drivers) that was so polite it could only have happened in Canada, the government, rather than talking to them, enacted never-before-used “existential threat” and anti-terrorism legislation. The State froze protestors’ bank accounts and left a permanent record of their disobedience. When ordinary people who supported the protests donated money for food and fuel (winter in Canada is no joke), not only were their donations frozen, but in some cases the personal bank accounts of donors were frozen too. Remember kids, money in the bank is not your money. You buy food and pay rent only if the State approves of you. Decentralised donations made in Bitcoin, incidentally, got through.

As if the government controlling your money indirectly by putting pressure on banks and companies isn’t enough, sometimes those companies themselves decide to just take your money.

PayPal, emboldened by the lack of outcry at their cancellation of various free speech accounts, decreed that it would fine $2,500 from customers each time they promoted “misinformation”. They reversed this decision as soon as it became obvious that everyone hated it (but quietly kept a similarly overbearing and vague clause about “discrimination/hate“), saying that it was an “error”. The irony, of course, is that Paypal thus admitted that its own legal update was misinformation. Now, where’s my $2,500?

Sometimes, companies don’t take your money, but presume to tell you what you can and can’t spend it on. Several UK banks recently banned their customers from transferring money to cryptocurrency exchanges, equating any kind of investment or trading in digital currency not issued by the State with “scams”. While it’s true that there are scams in crypto, just as there are (more and bigger) scams that use fiat money, a blanket decision by strangers about what I do with my own funds is beyond inappropriate.

Very soon, the government will stop putting pressure on banks and payment processors to restrict your access to, and use of, your money. Not because they’ve decided it’s none of their business, but because they won’t have to. They can do it directly.

CBDC stands for Central Bank Digital Currency, but it may as well stand for Central Bank Direct Control, because that’s what it actually is. It’s a system that combines the worst of traditional finance (ruinous central planning) with the worst of cryptocurrency (every transaction can be tracked). With Bitcoin and other decentralised cryptocurrencies, although transactions themselves can be seen, they cannot be stopped, and users enjoy varying degrees of anonymity and privacy depending on the implementation. With a centralised digital currency, there is no anonymity, and any transaction can be stopped, altered, or reversed by the controlling authority.

The key difference with the CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and also we will have the technology to enforce that.

Agustin Carstens, General Manager of the Bank for International Settlements (the central bank of central banks), interview, 2021

This is not a someday-maybe thing. Ten countries have already launched CBDCs, over a hundred are researching them, and all of the largest and most influential organisations (EU, IMF, BIS, WEF, etc.) are pushing for it to happen.

Totalitarianism is nothing less than complete centralisation – of control, of opinion, of right and wrong itself. Human rights, sovereignty, and freedom are the opposite of this – located intrinsically within each one of us, decentralised by definition.

If the trend towards vaccine passports/Digital IDs, censorship, CBDCs, and compromised encryption is not reversed very soon, complete centralisation will be upon us, and human rights, sovereignty, and freedom will be obliterated.

And how we burned in the camps later, thinking: What would things have been like if every Security operative, when he went out at night to make an arrest, had been uncertain whether he would return alive and had to say good-bye to his family? Or if people had not simply sat there paling with terror at every step on the staircase, but had understood they had nothing left to lose and had boldly set up in the downstairs hall an ambush of half a dozen people with axes, hammers, pokers, or whatever else was at hand?… Notwithstanding all of Stalin’s thirst, the cursed machine would have ground to a halt! If…if…We didn’t love freedom enough.

Aleksandr Solzhenitsyn , The Gulag Archipelago

Well, I think that about covers it for the Horsepersons of the Apocalypse.

Conclusion

The Horsemen are coming – in fact, they’re already here.

- War: In addition to the reasons you hear about, a radical change in the monetary system could also create conflict.

- Inflation: Deflationary shocks will be short-term; the ongoing tragedy will be crushing inflation.

- Civil War: Serious unrest will be fuelled by the State not being able to fulfil its side of the social contract.

- Famine: Supply chain issues will be systemic for the next decade. We will not all be able to get or afford food and heat.

- Disease: A physically weak population is being weakened psychologically, vulnerable to a real or manufactured crisis.

- Totalitarianism: We are much closer than people think to a fait accompli where the State has total control of your reality.

Each of these disasters has been worsened by or brought upon us entirely by centralisation. I believe centralisation, and the removal of sovereignty, freedom, dignity and resilience that are its symptoms, is the single most useful lens through which to view news, politics, and one’s own choices right now.

Because we’ve used general principles and historical observations, these conclusions should remain true for several years. If you want to disagree with them, you need not just an uncomfortable feeling, but better facts.

Is this really what you think?

Oh, God no. These are just a few things for which I could easily find evidence to show you. What I believe is really happening is darker.

Is it all hopeless then?

Not at all. As a natural reaction to so much pressure and control and centralisation, decentralised alternatives will emerge into which one could usefully put one’s energy: alternative media, alternative money, and alternative models of trust. The white dot in the centre of the black half of the Yin-Yang diagram, if you will. Some people and places will enjoy interesting and more ethical new ways of living.

But there will be a period of strife. Starting now.

This doesn’t seem to have much to do with investing

Yeah sorry about that. I do think a market melt-up is coming in spring 2023, followed by the meltdown to end all meltdowns, and I hope to have time to write about it before it happens. Update: I wrote about that.

What should one do?

Check whether what I’ve said is coherent with itself and with known facts about the world. Follow some links (there are Easter eggs and jokes as well as proper references). Base your decisions on principles, not emotion. Don’t fear. Try and take back control of as many aspects of your life as possible. Decentralise; reduce your reliance on large systems.

Get the fuck out of the city. The horsemen are drawn there.

For practical suggestions, check out my article on the Civilisation Collapse Stack.

🌍 Share this:

Want more to read? Here are my latest articles: