First published 27 March, 2023

This is a follow-up to my article Apocalypse Nowish, which made these points:

- Large trends are underway in War, Inflation, Civil War, Famine, Disease, and Totalitarianism.

- The situation will keep getting worse, as long as observable incentives and trends continue.

- The main cause is centralisation, i.e., the Government – every major political party, opposition party, and international body – is doing this to us (with very rare exceptions).

If you have time, do go and read that article first.

Since I finished writing it, the trends I described have indeed continued, e.g., pension riots, food shortages, censorship, weakening of the petrodollar, and acceleration of military conflict. I don’t want to be right, in the larger sense that I don’t want the world to continue getting worse, but I do want to be right, in the limited sense that I have something specific to say about what comes next and it’s important to have established some credibility first. That’s why I took the time (several months’ writing and researching) to spell out the reasoning behind each conclusion and give links to reports and data so I could basically prove what I was saying.

This article, by contrast, will be much shorter (hurray!) and will have comparatively little of that time-consuming argumentation. Instead of describing general trends, which have a very high probability of continuing and being proven right, it will make specific claims about the near future. There is, therefore, a higher chance of it being wrong, and a higher chance of it being much more useful if correct.

As you might expect, it’s about money.

The financial system is rigged

A very short background: Modern fiat currency is based on debt only. The amount of currency increases exponentially, by design. The last 40-50 years of economic policy have created ever-larger booms and busts. There is ever-smaller room for the central planners to fix things when they break, and they only have one tool: printing money (it comes in various clever disguises: lowering interest rates, purchasing financial assets, Quantitative Easing, Bank Term Funding Program, Discount Window, etc.).

Ultra-low interest rates, bank bail-outs, corrupt legislation, captive regulators, and steady inflation have combined to create extraordinary circumstances, in which these perverse incentives have flourished:

- The government wants to make your money worth less each year, exponentially less, so that it can afford to use debt to spend more money than it earns, to bribe voters, please its friends, and stay in power.

- The bankers want to take as many risks as possible, legally or illegally, with your money, so that they can get rich much faster than the worth of money is decaying, safe in the knowledge that there have never been any consequences to them for doing this, even when the consequences to others have included ruination and starvation.

This means: No-one with any power over events has incentives aligned with yours.

A melt-down is inevitable

Don’t be fooled: just because these crazy circumstances have lasted for decades doesn’t mean they are in any way “normal”, or that they can last.

Money as we know it is scheduled for execution.

Anyone who believes exponential growth can go on forever in a finite world is either a madman or an economist.

Kenneth Boulding

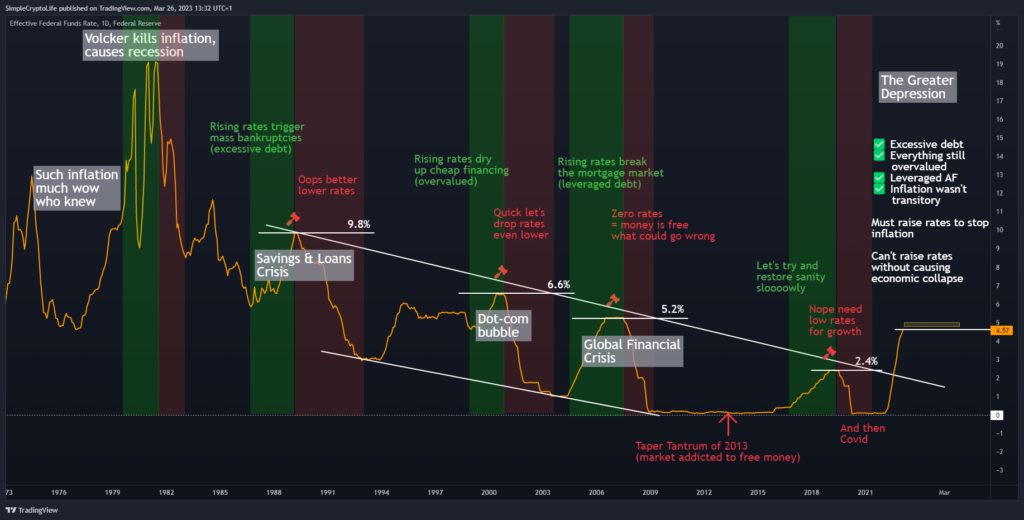

As I make the case for graphically in my article The Fed Funds Rate, the cycles of increasing and decreasing interest rates, which is just another way of debasing money, have now come to the end of the funnel. I wrote there that if they raised rates above 2.4%, let alone to 5%, it would break things. Well, they did. And it did.

Banks are all unstable, all the time

Everyone knows there is now a banking crisis. What is surprising, though, is why.

Silicon Valley Bank was the second-biggest failure in US history. They had parked their money not in tulips, not in cryptocurrency, not in giving mortgages to people with no jobs like in 2008, but US government bonds. The “safest” investment possible, so we’re told. Unfortunately, the value of bonds goes down when interest rates go up. Everyone who knows what a bond is, knows this. Now, the Fed has a policy not to surprise the market. Everyone knows that raising interest rates is the only way they can “fight” inflation (don’t get me started on demand destruction). Obviously we were going to get inflation after all the rampant money-printing. The Fed told everyone they would raise rates, and then they did. It was not a shock nor a secret that the value of the bank’s portfolio would drop. And when their depositors finally noticed, they took their money out. And the bank collapsed.

Remember that this bank passed all its stress tests. It was heavily regulated. It regularly reported to the Fed exactly what assets it had and, ahead of time, what gains or losses it expected. And yet it still collapsed and everyone made this face:

What’s the point here?

The root cause of Silicon Valley Bank’s collapse was that it did not have enough money in reserve to pay back its depositors. This is by design and is called fractional reserve banking. Or, since the Fed reduced the reserve ratio from 10% to 0%, “fictional reserve banking”.

Your money is not in the bank.

I know this is hard to believe, so I’ll say it again. It’s not there. It’s been lent out many times over to other people who may or may not pay it back, or invested many times over in things that may or may not return a profit.

This is true of every modern bank, all the time.

Yes it was a dumb move of Silicon Valley Bank to go overweight bonds in a low-interest rate environment. Yes their management were in all likelihood irresponsible, virtue-signalling clowns. But that doesn’t change the fact that US banks in general are holding unrealised losses of $1700,000,000,000; they’ve bet heavily not just on bonds, but commercial real estate, and the favourite asset of 2008, mortgage-backed securities. Does anyone really think office space is a great investment in the Zoom era? How’s your confidence in everyone’s abilities to repay their mortgages over the next few years?

The only difference is that the depositors of SVB noticed. A few smart, rich CEO types saw that bonds were going down in value, and they knew that the bank had invested in bonds, and they decided to remove their cash while they could, and all hell broke loose and the government had to intervene to stop a meltdown.

Quantitative Tightening, which is sort of the same thing, in order to contain the

banking crisis. And they’re doing it fast. Very fast.

Incidentally, the government cannot afford to insure everyone’s deposits; that’s a scheme to prevent panic rather than an actual safety net.

The difference between business as usual and catastrophe is thus only whether people notice that bonds, stocks, housing, etc., are losing value, whether they know that their bank has invested in them (they all have), and whether they believe that banks can fail. It’s psychological. If, in keeping faith in the banking system, you are gambling that, in the Internet age, no-one else is going to figure this out, the odds are not on your side.

Contagion is simply when one house of cards falls against another one.

The banking crisis will spread.

Everything is overvalued

In America in 1950, the average house cost about 2.5 times the average household salary. In 2022, it cost more than 7 times the median salary. The days when the husband could go out and work while the wife took care of the kids are long gone; nowadays both Zim and Shlerr have to work full-time just to afford their Outrage-Spice Lattes. Housing is overvalued. And to those that say that demand will always outstrip supply, I say that what matters for prices is not just the desire to own a house, but the surplus to pay for one.

Stocks are fundamentally overvalued. The average dividend paid by the most successful equities is around 2%, less than the official inflation target. If you’re losing money, in real terms, holding stocks, why buy them? Why are prices always going up? It’s simply a game of The Bigger Fool. There’s always another player, some financial institution flush with freshly-created government credits or some citizen saver with nowhere better to put their cash, who will buy it off you at a higher price. Until there isn’t. The real-world economy got much worse in 2021, while stocks ran upwards. Stock valuations are no longer based on anything in the real world.

Companies are overvalued. Many now can’t even make enough money to pay off their debts and are just shuffling along waiting to be put out of their misery.

Bonds are overvalued – at any price. When governments are running increasing deficits of more than yearly GDP, they are becoming insolvent. When each dollar of debt buys less and less productivity over time (as measured by debt-to-GDP), this train is clearly heading into a wall. Why would you lend money (which is what buying a bond is) to someone who’s ever-more insolvent? The bond market has been manipulated by governments getting their own central banks to buy their debt. This is hiding (not very well) the plain fact that lending money to governments is no longer a good idea.

Valuation is not value

Rising valuations of assets allow their owners to borrow more against them, which fuels more buying, which increases valuations. In other words, easy credit makes prices rise for no fundamental reason.

Let’s say you buy a house. In a few years, it’s “worth” more than what you paid for it. But in real terms, is it worth more? Are the bricks and wood worth more? In terms of the ultimate unit of account, hours of human labour, has anything really changed? Yet the valuation is higher, so you can sell it and buy a more expensive one – really, borrow more money against an even more inflated asset. People have been doing this over and over for decades. And price has gone further and further from true value, whatever that may be.

Just take a moment and think: On what are modern valuations really based? Primary wealth, as Chris Martenson brilliantly explains, is farmland and forests, oilfields and mines, and so on. Secondary wealth is the food, wood, fuel and metals that we can, with skill, make from them. Tertiary wealth is all the variety of paper derivatives of this real wealth: share certificates, mortgages, bonds, and other debts. Tertiary wealth is, in the best case, only a claim on real wealth, and even then the claims have been inflated far beyond the real assets and will not all be redeemed. Currency itself used to be a claim on gold, but is now a claim on “the full faith and credit” of a government, whatever that means. And the vast majority of the “money” in the world is locked in the form of bets between institutions, derivatives contracts with nothing backing them at all.

If you prick the bubble of decades of money printed against nothing, what really is the true value of paper derivatives, of our entire money system? I suspect it’s unfathomably less than current valuations. Crises have a way of reminding people what reality is.

Ordinary people are vulnerable to a revaluation

Workers are striking, as earnings cannot keep pace with the inflation that’s been unleashed by the central planners. Unfortunately, when zombie companies cannot afford to run anymore, either due to high interest rates or the stress of inflation, domino layoffs will hit the working class hard.

Those on fixed incomes are not safer. Pension funds are underfunded, as evidenced by the recent emergency action of the UK government to prevent its pension funds collapsing, along with most social security type funds.

Household savings are pitiful compared to previous generations. Home “owners” are damned-if-they-do and damned-if-they-don’t: they will struggle to pay the mortgage either if high interest rates increase payments or if low interest rates stoke inflation and cause a true cost-of-living crisis. In fact, because of the long-term rise in house prices, most people’s houses are actually assets of banks – the same banks about to go into crisis and be forced to sell their assets.

Speaking of bank assets, legal changes after the Cypriot banking crisis make it legal in most countries for the bank to use depositor funds (your savings) to bail themselves out in an “emergency”. It’s called a bail-in and it’s a real thing.

Whatever wealth you think you have, unless you can hold it in your hand, it could simply vaporise.

Yes but specifically when?

The above are simply a few reasons why the financial system is fragile. But why would fragility actually turn into collapse, and when might that happen?

Raising interest rates and holding them above 2.4% would kick it off it, as I mentioned, and that has already happened. Banks and ordinary companies become unable to afford their debt, default, and set off a cascade.

If they lower rates again, will it fix the problem? Well, no. The funnel is now so tight that it is obvious that this is the last chance. When interest rates are lowered, it is a signal to everyone who controls real amounts of money that inflation has won, the currency is doomed to rampant debasement, and no investment is safe anymore.

Here’s the same chart I put out in September last year, unchanged but for the current interest rate and the current target in the yellow box:

Just one specific example: what foreign power will buy US government debt when they turn the printers on again, with no plan and no end in sight this time? What is the point of being paid back in 2, 10, or 30 years with dollars that are now debased and worth a fraction of what you paid for the bond? No-one will want dollars or dollar-denominated debt. Remember that the bond market is far bigger than the stock market. Without the huge influx of foreign cash to which it’s accustomed, the US economy is doomed, and therefore the world economy.

So in reality the meltdown has started, although all seems relatively quiet for now.

And when will it become obvious? The market is pricing in a Fed pause in rate rises next month (May 2023), and cuts this year.

How bad could it get?

How bad could the Global Financial Crisis in 2008 have been? How bad could the collapse of Long-Term Capital Management in 1998 have been? In a true return to reality, only those companies, institutions, and valuations backed up by real stuff will survive. The entire sandcastle of modern finance is built by leveraging and multiplying, over and over again, on top of a thin sliver of actual money, which is itself a debt-based mirage. There is little practical limit to how bad it could get.

Recall that the collapse of Long-Term Capital Management was prevented by a back-room deal between big banks that had lots of money. The Financial Crisis of 2008 could not be prevented, but the effects were managed (kicked down the road) by flooding the system with money.

Neither of these “fixes” will work again this time: When it’s the big banks that need rescuing, the only player to deal with will be the central bank. If they print the unimaginable amount of money needed to buy everybody out in a bankruptcy crisis, or to flood the system with money to “fix” a credit crisis, or both, welcome to hyperinflation. When strong inflation ruins businesses, as it does, and productivity stagnates and falls, we get the worst of all worlds: hyperstagflation.

A melt up is possible

We are between two huge forces: inflation on the one hand, and a crisis-driven (deflationary) crash on the other. I submit that most will get crushed by both. It is, I hope given the above, easy to see why the meltdown is coming, and I say it will actually come before inflation really gets roaring.

So what’s all this about a melt-up?

It is possible that markets run up wildly before they get smashed down for what, for all intents and purposes, may as well be the last time. The smart money, of course, took profit on the big run up in 2021, and exited when the Fed said they would start raising rates again. There is, therefore, trillions of dollars sitting on the sidelines.

When the Fed say they will pause rate rises, this could be the cue. Big players will anticipate a return to easy-money conditions. Since the market is forward-looking, they won’t wait for the actual rate cuts. This thesis isn’t mine, it’s from an analyst called Kyle Heinemann from silverchartist.com, as is the timeline below. It’s a contrarian idea based on the notion that Wall Street is run by crooks, who will take one last chance to squeeze what they can from the little guy. I think that’s quite a likely premise.

According to my reading of Jay Powell’s speech of March 22nd, this has already happened. He strongly hinted that May would likely be the last rise, which makes May the “pause”.

Just as everything crashed in March 2020, everything would rise in a melt up; the riskier the asset, the more it goes up.

Timeline

History:

- March 2022: Fed “realises” that printing money causes inflation, hundreds of years after everyone else. Raises rates.

- October 22: Yours truly, and many much smarterer people, say that this will break things.

- March 2023: Banks start to break. Fed blames the management of the banks and says, “The banking system is safe.”

The Fed raises rates 0.25% and hints that May will be the last rise.

Speculation:

- April 2023: Banking crisis worsens and is in the news. Yet markets grind higher. Ordinary people do not participate, because they feel bad from watching the news instead of the charts.

- May 3rd, 2023: The Fed cites banking weakness, falling inflation, or whatever made-up statistics it needs to stop raising rates. They either do one last 0.25% raise, or don’t raise at all.

Markets blast upwards against all reason. - May 2023: News about the banking crisis is replaced by feel-good news, citing falling inflation or whatever made-up statistics come to hand. Banking crisis quietly continues.

Ordinary people start to reinvest in the markets due to Fear Of Missing Out. - June 2023: Markets peak in a parabolic blow-off top. Wall Street sells everything and goes short. Markets dump like it’s (tech stocks in) 1999. Joe Six-Pack tries to “buy the dip”, but it keeps on dipping.

- Summer/Autumn 2023: Banks fail. Companies fail. Ordinary people (who aren’t allowed or don’t know how to short) see their savings, pensions, and house equity wiped out.

- 2024: Everything based on debt and leverage is gone and doesn’t come back for another decade. Real things increase in value.

UPDATE Sept 2023: The Fed has been taking their sweet time, holding rates “higher for longer”, which has extended the timeline given above. But nothing fundamentally has changed. I now think Q4 2023 for the meltup, assuming as always that They don’t blow up the economy first.

Big flashing caveat

There may not be a melt up at all if everything breaks first. If a major stock index makes lower lows or goes limit-down, this would go a long way towards invalidating the meltup theory. The melt up happens in a very small window between the causes for the crash becoming obvious (i.e., now) and the effects of the crash becoming overwhelming (in a few weeks or months).

Counterparty risk spoils the party

Let’s say you manage to make money in the meltup, or at least to exit your investments somewhere between here and the top. Or we don’t get a meltup but go straight to breakdown. Now you have a new problem: where do you keep your money?

Money in the bank is not safe, because of bankruptcies and bail-ins. Deposit insurance limits will mean very little in a true melt-down. In Switzerland, one of the safest and most democratic countries in the world, they literally rewrote the law on a weekend so that they could push through the takeover of Credit Suisse against the interests of its creditors. Hiding behind a flimsy piece of regulation will not work in a real financial hurricane. If you’re unlucky, will they take 100% of your deposits? Probably not. Who knows.

Cash might be safer, but it’s not practical to obtain or keep large amounts: that’s why we have the damn banks in the first place.

Gold is a traditional method of wealth preservation. Yet gold will also get sold off hard in a vain effort to prevent margin calls – at least, at first. Long-term, gold is probably a very good call, as long as you can stomach holding it while 50% of your net worth disappears in the short term. Getting a bit more advanced, one could play the gold/silver ratio: buy silver before the melt-up, or, more generally, in the anticipation of precious metals in general going up in price, and then exchange the silver for gold before they both melt down (if in the aftermath commodities outperform other assets, as I think they will, one would then switch back to silver). The theory here is simply that silver moves more than gold, both on the way up and down. This way, you can keep your currency in the form of real money the whole time. Watch out for tax implications (that’s generally a good idea for any strategy) and avoid any paper gold that’s not fully allocated.

Bitcoin is the modern “digital gold”, designed specifically to protect us against a repeat of 2008. It is an inflation hedge because it cannot be printed at will. Yet it is probably the worst place to be in a deflationary crisis. Bitcoin has been behaving like a risk-on asset, not a safe haven. The large amounts of institutional money, which crypto enthusiasts like me cheered for in order to promote “adoption” and higher prices, will sprint for the exits, crushing price. I should note that there is a rival theory, hyperbitcoinisation, which says that Bitcoin will be the only asset left standing as everyone finally realises it’s the only true safe haven. I would like this to be true, but I have my doubts. I think governments the world over are getting ready to choke off citizens’ access to crypto in favour of the ultimate shitcoin, CBDCs. Personally, I might buy a little Bitcoin after the crash, and hold it quietly for ten years until the dust settles. And in any case I will watch the charts and change my mind if it looks like the Bitcoin Milkshake theory is playing out after all. But, do your own research.

Altcoins? If you know one whose value is tied to real-world, tangible assets that will not also dump in a crash, please do let me know so I can hold some. I will trade them up till my eyes bleed if we get a meltup, but avoid holding them like radioactive rat poison.

How about stablecoins? They have “stable” in the name, right. Crypto assets pegged 1:1 against the dollar, such as USDT, are vulnerable in a Great Deleveraging precisely because they are tied to the legacy financial system. Some bank or other holds those dollars (in theory).

Should you pay off your mortgage? Real estate might drop less than other assets (hard to tell). And moving house is a real hassle. Getting rid of debt is a good idea, but holding a hard-to-shift asset in an area that will become less liveable (i.e., a city or any urban area that doesn’t grow anything) if and when there are serious problems, is not.

What if we go short? You could short crypto on almost any exchange. You could use spread-betting or Forex platforms to short all kinds of stocks, indices or commodities. That seems smart, since everything is dropping. But there is still counterparty risk – which is hard to quantify from outside – since the exchange is itself a financial institution.

There are no 100% reserve banks that I know of, which is a shame because they would be good places to park your cash. Digital precious metals exchanges like Kinesis, however, are sort of equivalent, since they’re audited to actually have the physical metals they issue tokens against. So counterparty risk should be low. Most assets that you can hold there, such as digital gold, digital silver, USDC, or Bitcoin, are vulnerable as described above. They do have the option to hold USD/GBP/EUR balances there, though. How safe this is depends, I suppose, on how those balances are held. Since Kinesis is very unlikely to be fractionally lending them out, this is potentially a very interesting solution. I’ve asked them and will update my email subscribers if they have a good story about this.

Finally, one might consider non-financial investments. Education, strengthening one’s legal position, buying durable food, tools, or other useful things could be ways to invest in life to which a falling valuation in monetary terms isn’t particularly relevant.

Epstein didn’t kill himself

Since it should be obvious by now that this is entirely a manufactured/avoidable crisis, perhaps you’ll indulge me a little theory that its end is also manufactured.

People like to bash the Fed and say they’re stupid, howling about why they can’t see the damage their “policy errors” are doing. But remember the power of incentives. Since when did any of the Fed’s actions do any damage to their shareholders? To ordinary people, yes, but to anyone that matters? Running markets up and down, enabling soft-money partying, and debasing the currency all make money for those who already have money and power.

The Federal Reserve, and the financial policy of the United States that it shapes, single-handedly created the fiat, soft-money empire that enveloped the world over the last century, first by taking control of US money-printing in 1913, getting the American taxpayer to pay them for every dollar they printed, imposing the dollar standard on the world in 1944, and squeezing the dollar off the gold standard by printing more IOUs than there was gold, until Nixon had no choice but to end it in 1971. Given the exponential growth in the money supply, one can only assume that this private, for-profit banking cartel got richer than God in the process.

I don’t believe the Fed is stupid. If some schmuck like me, with no relevant education or training, can see, months in advance, what consequences their actions will have, do you think an organisation full of PhDs, with all the money and information you can dream of, don’t see it too?

Policy errors? There are no policy errors. It just looks like that if you think they’re on your side. Why would you assume that?

They’re executing a plan. They know as well as anyone that the days of the current fiat system are numbered (monetary systems last an average of ~40 years). The banking crisis will be used as an excuse to consolidate US banks into as few companies as possible, the easier to control them.

When the populace screams for the government to “Do something!” they’ll distribute Universal Basic Income, to “help support” people from the carnage they created. At the same time, the central banks will issue Central Bank Digital Currencies, a hellish solution no-one asked for, and make it mandatory to use them in order to get your dole.

The middle class especially, but basically every class except the parasite class, will be crippled, tracked, and controlled.

https://twitter.com/wef/status/808328302213689344

What to do?

I’ve tried to give some general principles about what one might buy or sell to take advantage of a melt up or protect from a meltdown. I will, to keep myself honest, post a few example trades that I’m actually taking, on TradingView, with the tag #tradingtheapocalypse.

For practical steps that aren’t to do with trying to make money by speculating on this meltup/meltdown, see The civilisation collapse stack.

For more background to this article, which could be rather jarring if you’ve been suckling thus far at the teat of the mainstream narrative, see:

- A Brief History of Money

- A Brief History of Commercial Banks

- A Brief History of Investment Banks

- A Brief History of Central Banks

- The Fed funds rate: how this one stupid number is about to ruin your life

- Apocalypse Nowish

🌍 Share this:

Want more to read? Here are my latest articles: