(Article first published Oct 2nd, 2022)

I’ve made a lot of money trading – and lost a lot, too. In an attempt to skew that balance firmly and forever to the upside, and to help you do so as well, I’m going to analyse the losing-est things I’ve done over the last several years (more or less in chronological order), and list out the antidotes.

Imagining the future will resemble the past

Confession time – the very first thing I did when I got a trading account was to buy the Great Crypto Top of 2017. I thought all crypto would keep going up because it had been going up.

It did not.

Many of the things I bought lost 90% or more of their value within weeks.

There is a simple perceptual problem with crypto, because someone else sets the default timeframe and length of the chart that you can see, whether it’s on an exchange, or on one of the many coin comparison sites. Combine this with the fact that the hottest crypto projects are always the new ones, and therefore don’t have much price history, and the default view is extremely short-sighted.

⭐ Antidote: Learn about cycles.

Get a TradingView account. Zoom out. Learn to use weekly charts (I can feel the pain of dopamine-junkie crypto traders even thinking about such high timeframes) as well as daily and lower. Study the price history of Bitcoin (or the main asset/index in your chosen class) until you can name the date by the shape of the chart.

I read a whole book (made of paper; remember those?) on market cycles. Starting to educate myself wasn’t the end of my recklessness and pain; it wasn’t even the beginning of the end, but it was the end of the beginning.

Not using stops

This is really one aspect of confusing trading with investing, which we will come to later, but it’s so common and so ruinous that it deserves its own section.

If you don’t set a price at which your trade has obviously gone wrong, you are exposing yourself to losing 100% of your trade amount – and if using leverage, 100% of your entire account.

Lack of a stop says “I’m going to wing it!”, which is equivalent to “I love eating ramen in the dark!”. It encourages you to continue screwing up your trade. You might get irrational and insist that you are right and the market is wrong (good luck winning that argument). You might add to a losing position. You might hold it for unnecessary losses. You might spend precious mental capital watching and hoping that your trade magically goes your way (if you ever meet the Trade Fairy please send her my way; I have a bone to pick). Whatever happens when you fail to set a stop – even if your dumb ass makes a profit – it’s a failure.

I’ve blown up my leveraged trading account multiple times (pro tip: a liquidation level is not a stop!). Only after a year or so did I make a rule to always use stops.

⭐ Antidote: Always use a stop.

Using debt

If you get a good deal with low interest, the debt isn’t a large proportion of your net worth, and you use it to expand on something you’re already been doing for some time with consistent success, debt can be smart. In all other cases, it is not.

After my first few trades made big profits (because I was a genius, obviously, not because it was a raging bull market and a blind armless monkey could have picked a basket of winners) I took out personal debt to “invest” in my chosen market, with no experience or skills. When the market had different ideas to me, I was pretty much ruined. Likely the single worst decision I ever made.

I almost quit. Instead, I decided to learn, and survived to trade another day.

Technically, trading on margin is using debt, but as long as the money you put into the margin account is your own, it’s not quite so dangerous. I think using margin is fine, if you have the skills to do it. As a beginner, you do not.

⭐ Antidote: Don’t use debt. Use margin only if you have the skills.

Taking financial advice from strangers on the internet

I tried every possible kind of financial advice from strangers – free groups, paid groups, automated signals, newsletters – and it did not work. Or rather, sometimes it did, sometimes it didn’t, and I couldn’t tell the difference.

There is an entire industry devoted to preying on your lack of knowledge as a new trader. There’s very little accountability. Crypto is the worst, because there’s rarely any kind of track record, the whole space being so new.

Even if someone is totally honest and very skilled, you will, on average, still lose money by blindly following them. Honest Bob’s reason for entering a trade might be sound, but if he’s not there to advise you when the trade is turning against you, when to take profit, when to increase your position, or when to take the loss and move on, you can still mess it up.

⭐ Antidote: Own your own trading strategy.

First you need to find your own trading style, and master your own set of rules for choosing, entering and managing a trade. Only then can you properly put information from others into context. If you can’t understand someone else’s analysis to the point where you can own it and maybe improve it, it’s not yours and you shouldn’t put your money on it.

This seems like an appropriate time to say that I am a stranger on the internet and this article is not financial advice.

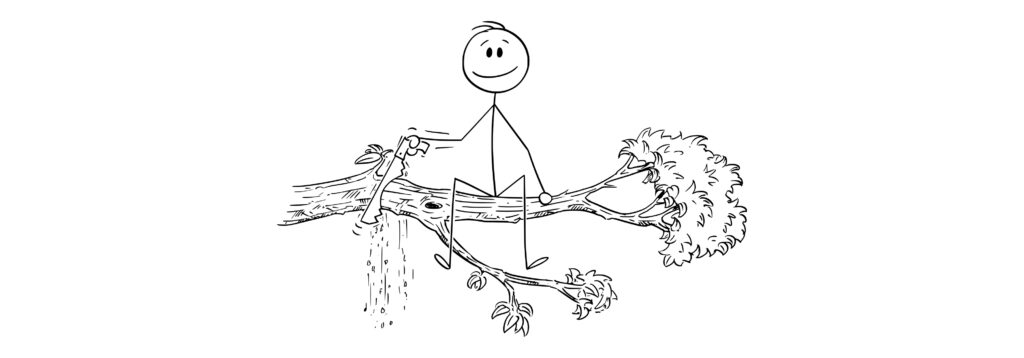

Investing

When I discovered crypto, I thought I was investing in exciting and worthwhile projects (MUH real-world use case!). But investing is a terrible idea, if you confuse it with trading. To me, the difference is not the length of time you plan to hold it for, although that’s usually a good clue. The difference is that investors don’t need a plan. And traders do. I didn’t have a plan for what to do if the world didn’t recognise that it needed changing in quite these ways at this time (grrr stupid world).

If you buy something as an investment, you are really putting your faith in some long-term trend – stocks always go up, there are never enough houses, or what-have-you (most of the time this is just the currency depreciating in real value, but that’s another story). If the price of your Picasso/wine/index fund goes down, that’s ok, because it will recover eventually. This isn’t always true, but it is true often enough that financial advisors can make a decent living by just telling different people to buy very slightly different mixes of the same few assets. And it’s true often enough that people invest all their money in one or two things (even if those things are a basket of other things, they are still correlated).

Traders, by contrast, should never go “all-in”.

Likewise, if the price of, say, gold coins goes down, investors can happily Dollar-Cost Average and buy more at the lower price. But for traders, this is a road to blowing up your account. For leveraged traders, it’s a very fast road, downhill, slick with oil and littered with banana skins, with spikes at the bottom.

⭐ Antidote: Plan your trade, and trade your plan.

Work out all of these things in advance, and then set alerts or check the trade at intervals until it’s closed:

- Reason for entering a trade

- How to know when that reason is no longer true and it’s time to exit

- Points at which to take profit

- Maximum allowable risk for this trade

Up-only

For months, I traded “spot”, which means buying and selling the actual asset. On the plus side, this is, relatively, safer (in much the same way as being trapped in a cupboard with a rabid raccoon is safer than being trapped with a whole troop of them). On the downside, it encourages you to confuse trading with investing, and is technically very limiting. In a bear market you can make a lot of money by short-selling, which is essentially just the same as going long, but, like, upside-down. If you don’t know how to use margin, you can only sit in cash and wait, and try to guess the bottom.

⭐ Antidote: Learn to short (or be comfortable with holding cash as a trade).

Professionals, banks, hedge funds, and the like all trade both long and short. Joe Six-Pack only buys, either out of his control via his pension, or (and one hardly knows which is worse) in his control via his smartphone. Guess who gets rich.

Talking about trading

I’ve been a member of many trading groups and chat rooms. And with all due respect to the fine folks I met and befriended, this was 95% a waste of time.

Trading – whether winning or losing – is exciting. There is always always a boom or bust somewhere, always a trade. And trading is uncertain – even the best in the world don’t know whether they will win or lose any particular trade. To relieve this constant uncertainty and excitement, traders love to socialise. Stock traders allegedly all get drunk when the market shuts. Crypto traders just stay up late (damn you, 24/7 markets) and shitpost.

Is it possible to learn something and become a better trader by chatting with other traders? You’d think so, but I find most interaction is stress relief and nonsense. Traders also reach out to other traders to find out what their bias “should” be, instead of doing the work to develop conviction through analysis. Time spent talking about trading is time taken from studying and practicing trading.

⭐ Antidote: Join a good educational group.

Charting and analysing is essential. You need to put in the hours to make the concepts you’ve learned become second nature. A good group (you might have to pay) will support you, and will definitely have separate channels for different kinds of chat, allowing you to keep your distraction/entertainment/procrastination time to a healthy minimum.

Trading, once you’re doing it properly, isn’t exciting. Gambling is exciting. Trading is work.

Using Twitter

Twitter is a bullshit factory run by deranged monkeys. For trading you need to be calm, confident, and poised. But Twitter makes us anxious, distracts us, and consumes our attention, by design. Its algorithms reward sensationalism and its format makes deep analysis impossible. Trading + Twitter is a perfect storm.

I’ve found myself scrolling through Twitter, trying to find someone to confirm my existing bias, only to close it half an hour later just as confused but now also fearful and angry. And then doing it again the next day.

And yet, there are also smart people on there, saying useful things.

⭐ Antidote: Use TweetDeck or quit Twitter.

TweetDeck is a web app in which you can organise people you follow on Twitter into columns. This gives you back some control over what you see, instead of scrolling through a big list of everything, with distractions and ads. It also seems to bypass at least some of the sly censorship – I’ve noticed tweets from certain people appear in TweetDeck while being hidden in my main timeline. I have 7 people’s thoughts displaying in TweetDeck, and that’s enough for me.

Picking tops & bottoms

I lost money consistently trying to short Bitcoin in one of its amazing bullish runs because I wanted to short the top. Just foolish.

The fact is that retail (ordinary) traders get crushed trying to pick major reversal points. You will not buy the absolute bottom nor sell the absolute top, and if you chance upon it once you won’t manage again. You just won’t. But if you haven’t been through this very expensive lesson, chances are you don’t believe me. Fine. Go ahead and lose a few hundred times, and then come back and keep reading.

⭐ Antidote: Buy dips in an uptrend and sell rallies in a downtrend.

You absolutely need a high timeframe bias. If you want instead to go against the current trend, you had better know your edge very well.

Falling in love with an asset

I used to think that the most important thing was to figure out what to buy. The best things would rise when the market fell, or rise more when the market rose, I thought. This is an investing mindset, not a trading one. It leads too often to falling in love with a coin, a team, a project, a company, or a use case.

When you’re in love, you ignore faults and amplify beauty.

⭐ Antidote: Use fundamental analysis for filtering assets.

Fundamental analysis (FA) can tell you what to trade, and technical analysis (TA) tells you when to trade.

Choose a big list of strong or weak assets based on your research or on some metrics. Then long or short them based on your technical strategy. Buy dips in strong assets in an uptrend. Short bounces in weak assets in a downtrend. You’re welcome.

Reading financial news

I used to think I needed to “be informed”, and consumed large amounts of news, marking important dates in advance and checking announcements – and utterly failed to profit from this.

News is an illusion.

Financial news, doubly so.

If you get your news for free, and you don’t know who is paying for it and what their agenda is, you are being manipulated. Nowhere is this clearer than the financial news. Articles constantly confuse correlation with causation. They’ll tell you that some move in markets came “as” something else happened, strongly implying that the event caused the move. In fact, the cause is something else they don’t mention. Often, the underpaid drone from Sector 7-G writing the article doesn’t know what the real cause is, and so instead of manipulating you, they’re just wasting your time. In any case, the lead-up to the move was often already visible in the charts before the event occurred.

The biggest problem with trying to use the news to trade with is that it is by definition late. Not only that, but unless you subscribe to an expensive specialist service, now everyone else knows it. The majority of the money in any given market is controlled by people who are better informed and better financed than you, so the chances of you getting an edge over them by using late, public information, which they probably paid to feed you in the first place, is close to zero.

⭐ Antidote: Trade your charts.

“When the chart is ready, the fundamentals appear.”

Shiny toy syndrome

Arguably, cryptocurrencies themselves were a shiny toy for me. Then I “invested” in Initial Coin Offerings (ICOs), Initial Exchange Offerings (IEOs), microcap coins, and every kind of obscure little thing.

The hipster’s idea is that under-the-radar projects, penny stocks or microcap coins, and projects that hadn’t even launched yet offered the biggest possibility for returns. And this is true, but they also have the biggest risks. I paid big network fees trying to get into over-subscribed events. I was forced to sell coins that immediately traded at less than their pre-launch price. And I got flat-out scammed by projects that just died with no updates from the team.

Overall I lost money in this chase. I did make money, too, which (in one of my few wise decisions) I invested in good trading education.

What’s the fundamental flaw in shiny toy syndrome? It’s giving control away. It’s wanting someone else to magically make huge profits for you, simply because you turned up. It’s abdicating responsibility, which is the trader’s original sin.

⭐ Antidote: Trade liquid markets.

Markets where there are plenty of buyers and sellers, where there is some price history to work with, can still shake you out, but at least you can buy and sell whenever you want. There’s only one variable – the movement of price. You can create strategies, and backtest, and forward test. It’s much less of a lottery. It’s a fight you can learn to win.

Carrying too much risk

This one could equally be called “being impatient”, because that’s what it comes down to.

When I rebooted my trading career I learned about risk management and sized all positions according to a percentage of portfolio risk. This lone piece of discipline has allowed me survive a horrendous number of ill-advised trading decisions.

Speaking of which, I did once take a very large long position in Cardano, because I was sure that it was on the way up. But I used a new kind of perpetual futures contract that was itself collateralised in Cardano. This made it almost impossible to gauge the real risk, because as the value of the asset fell, the position took a loss, but the margin that was funding it was also worth less. If you think this sounds like a really bad idea, you’re right: I ended up getting margin called.

⭐ Antidote: Use strict risk management.

Be patient. Make a small profit, and then do it again, and compound.

False diversification

I spent a long time researching different sectors of the crypto market, and bought coins in Decentralised Finance, Gaming, Privacy, and different Layer 2 protocols. Because yay diversity. But guess what – those were all crypto positions, and would all dump if Bitcoin had a bad day. No real diversification there.

You may shake your head at my tragic trading tale, but you’re likely imitating it in investing.

If most of your net worth is in your house, you are hideously over-exposed to interest rate changes. If your stock portfolio contains Tech, Energy, Consumer Staples, Health Care, and other sectors, you’re still at the mercy of the stock market, which booms and busts in phases. If it’s spread across stocks, Treasuries, short-term commercial paper, ETFs, and even the SPDR Gold Trust, you probably think you’re pretty clever well diversified. But all those things are vulnerable in the event of a liquidity crisis.

⭐ Antidote: Trade different markets (and keep profits in different financial systems).

True diversification is hard. But if you can trade long and short, or across multiple markets (two or more of crypto, equities, commodities and forex), or both, you won’t be tempted to load up on too many correlated trades. Plus, you can simply ignore a boring market and never feel tempted to force a trade. If you further spread your non-trading money across offline crypto wallets, “trusted” fiat custodians (banks), businesses, non-bank precious metals, and land and other hard assets, you will be in the top 1% of financially resilient people when things get weird.

Using macro analysis

Macroeconomic analysis is a wonderful thing when done properly. These days, what the Federal Reserve says they’re thinking of dreaming about maybe doing sometime next Tuesday if the wind is in the East seems to be the only important factor in determining whether we are risk-on or risk-off.

The wrong way to use macro analysis is what I was doing, which is trying to derive a trading bias. For example, excessive money-printing is inflationary, and precious metals are inflation hedges, therefore post-2020 my bias is up for silver. Well, yes, but over many years. This is an investing thesis that you can’t just apply straight to trading. To open a long position in silver you would still need a high timeframe (chart) bias and a technical setup.

⭐ Antidote: Use macro analysis for filtering sectors.

You can have a very high timeframe (months and years) bias for particular sectors based on your macro analysis. In the current inflationary, de-globalising environment, for example, when we seem to be in the beginning of a decade-long rotation from equities to commodities, mining stocks should do very well. Yet right now they are all getting crushed like my old car, and if you buy this bias you will get crushed too. The whole sector is, however, on a watchlist. I’m watching for a sector-wide, technical reversal and uptrend, because growth will be there and the risk:reward for trading individual stocks will be heavily skewed upwards.

Buy strong assets in bullish sectors in an uptrend. Short weak assets in bearish sectors in a downtrend.

Fractals and models

Crypto Twitter is full of this equine digestive byproduct. Someone sees a long-term pattern in a chart that happens more than once, makes a big deal out of it, and convinces other suckers that it will play out like this in the future. Whether it’s the Bitcoin Rainbow Chart, Stock-to-Flow, fractals, or any other model: if it looks too good to be true, it’s because it is.

I not only fell for several of these things, but spent ages coding up indicators based on them.

There is a kernel of truth to many of these multi-year models: Stock-to-flow is a real thing that helps explain why some rare things cost more than others. And Bitcoin is the first mathematical money: its supply decreases at a known rate, and this should indeed produce a sort-of-predictable inflation in price versus monies that do not. But not to any pretence of accuracy. The reason the models look amazing is because they’re tweaked until they fit the past very well. But as predictive tools they Do. Not. Work.

Special tools that only work on one asset might make you feel special, but they’re inferior to tried and tested tools (RSI, Moving Averages, support & resistance) that work on every asset.

⭐ Antidote: Avoid Voodoo TA.

I lost money by holding on to a bullish bias for far too long after the top of Bitcoin’s last bull run because the models said we would go to $200k+ this cycle. We did not. The weekly chart clearly showed weakness before the all-time high, and it played out. I should have traded my charts.

Trading too much

I remember trying to analyse too many charts, obsessively watch profit and loss of too many trades, and look for too many setups. By spreading myself too thin, my brain felt fried, and quality suffered. My analysis was shallow and half-finished before I jumped to something else. I was spending all my time looking for the next trade and none at all in improving how I was trading.

Over time, a good process always wins.

The most important thing is to create, test, and refine your personal system. A system has rules that you follow for each trade. Back testing and forward testing your rules gives you confidence. You know they will, on average, give you profit if you follow them consistently.

⭐ Antidote: Constantly improve your trading system.

If you don’t have a trading system, your random inputs will give random results.

Trading too little

I missed out on much of the 2021 bull market in altcoins because I was busy coding.

For me, coding trading indicators is part of constantly improving my trading system. I can quickly see market structure, set alerts for changes, and do other cool stuff. But when I would try to trade as well as code, I would get lost in the infinite possibilities of which assets to trade, and not make much progress in anything.

⭐ Antidote: Keep a core of favourite assets that you trade regularly.

When I have little time, I’ll just check a handful of things, to stay involved in the markets. When I have more time, I can do more.

Trading like a degenerate

I’m not sure I’ll ever be entirely over this one. This is the “put it all on black”, high-risk urge that whispers to us to catch falling knives, increase leverage, or to take this risky trade right now.

It’s trading from your emotions, not your technique. The really tricky thing is that emotions can twist any rationale into their service. It can even turn your wonderful trading system into a raging dumpster fire of burning banknotes.

For example, let’s say your system gives you a signal to buy, and a place to set your stop. But you don’t want to set your stop all the way over there, because when you size your position according to risk (trade amount x distance to stop) it will mean a smaller position. Boooooring. So you go hunting for a smaller timeframe where you can set a tighter stop and justify a bigger position and even Stevie Wonder can see it coming that you will get stopped out. You’ve turned a winning trade into a losing one.

Timeframe abuse is a real problem. Get help.

⭐ Antidote: Use a playbook.

A playbook is another way of looking at your system. It’s a collection of setups that have a high probability of working out in your favour, or, which is equally valid, that don’t work out very often but have such a good risk:reward profile that you will still come out on top if you take them consistently. Describe your setups in a way that includes what spread of timeframes are valid.

Everyone says you have to keep a trading diary, but to the degenerate part of you, reviewing your mistakes feels like punishment. It’s often easier to aim for positive goals. A playbook is a very positive goal. Of course, in order to create your playbook, you have to keep track of your trades and what works (but don’t tell your monkey mind and don’t call it a diary).

Summary

These were my worst trading mistakes, so far. I hope it was useful or at least entertaining to read about them. Here are the antidotes collected up all nice (printable version is here):

⭐ Learn about cycles.

⭐ Always use a stop.

⭐ Don’t use debt. Use margin only if you have the skills.

⭐ Own your own trading strategy.

⭐ Plan your trade, and trade your plan.

⭐ Use fundamental analysis for filtering assets.

⭐ Learn to short (or be comfortable with holding cash as a trade).

⭐ Join a good educational group.

⭐ Use TweetDeck or quit Twitter.

⭐ Trade your charts.

⭐ Trade liquid markets.

⭐ Use strict risk management.

⭐ Trade different markets (and keep profits in different financial systems).

⭐ Use macro analysis for filtering sectors.

⭐ Buy strong assets in bullish sectors in an uptrend. Short weak assets in bearish sectors in a downtrend.

⭐ Avoid Voodoo TA.

⭐ Constantly improve your trading system.

⭐ Keep a core of favourite assets that you trade regularly.

⭐ Use a playbook.

Happy trading!

🌍 Share this:

Want more to read? Here are my latest articles: